How the coronavirus will change office spaces

Offices have been trending toward open workspaces for over a decade, as employers look to boost collaboration and maximize use of space.

But as states begin to lift shelter-in-place orders and employees prepare to return to work, more than 80% of landlords and office managers are already re-envisioning the workplace, according to a study of 400 participants by VergeSense, a San Francisco-based proptech company.

“Every client we’re working with has one overarching concern: how do I create a safe environment for my employees, both from a health perspective and from an emotional and mental health perspective,” said Verity Sylvester, co-founder of Branch, a New York City-based office furniture company.

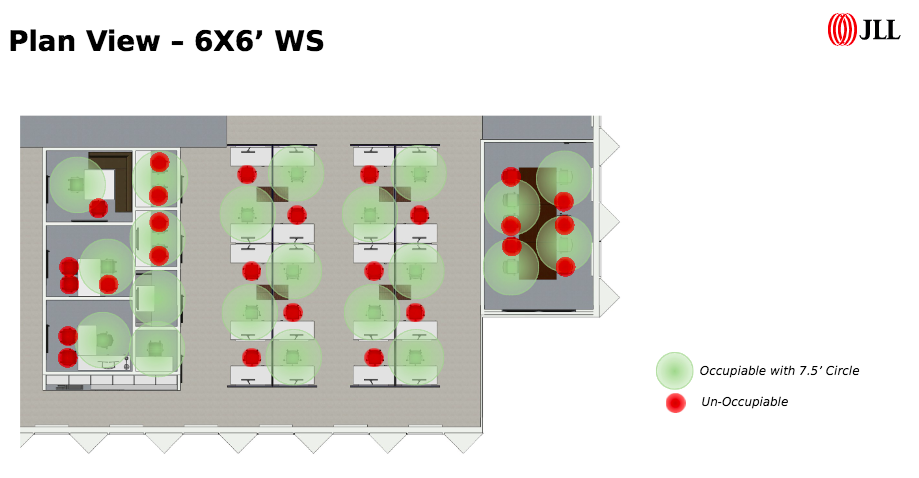

Companies are creating structural changes to encourage social distancing in the office. Some companies have ordered six-foot long desks, permanent wall dividers, cubicles and “sneeze guards,” or sheets of plastic separating employees’ space, according to office furniture suppliers.

“The ever-popular 'open office' trend is going to have to be quickly rethought and adapted — Nobody wants to bring their teams back to a true open concept environment,” said Sylvester.

Had an interesting Zoom today with a group of architects and office planers.

A nearly 100% sell-out of plexiglass and plastic/cloth office dividers.

One very large tech company—just today made an order for ~5000 that just about zeroed our all in the US.

3 month backlog. pic.twitter.com/xc5ZZg4hfe— Brian Roemmele (@BrianRoemmele) April 28, 2020

“We are about to see a reversal of a decades-long trend,” said Joe Learner, Savills vice chairman, director and Midwest Region lead. “For years and years, there has been a move toward densification and collaboration. Companies wanted more people into the same area, so they took away ‘me’ space and increased the ‘we’ space."

But restructuring an office is not practical for small businesses — a full-height cubicle can cost several thousand dollars per employee, according to Sylvester.

“There’s a divide in what companies can achieve in outfitting their office for the new environment,” said Sylvester. “Small and mid-sized companies just do not have the resources to invest in brand new office furniture, especially as we navigate through a challenging recession,” said Sylvester.

Cubicles and sneeze guards are not the only expensive items on companies’ futuristic office wish list. Companies like Amazon are using short-term measures like thermal cameras to detect employees with a fever. But thermal cameras do not detect asymptomatic carriers of COVID-19 and can reportedly cost between $5,000 and $20,000.

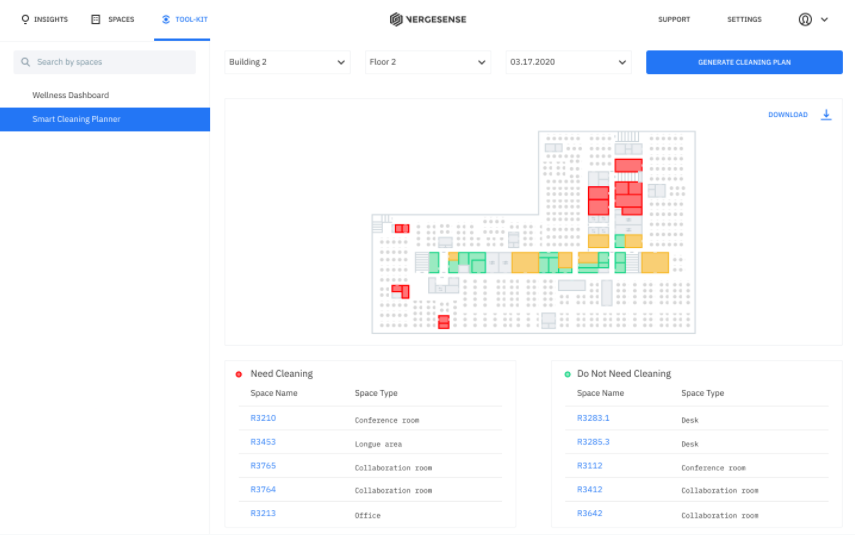

Social distancing sensors have also gained traction. Cameras and other sensors can track employee interactions, to flag areas of the office that need extra cleaning or trace who is at risk if an employee tests positive. One San Francisco-based sensor provider, VergeSense, had a 242% increase in the number of prospective installations this quarter compared to last quarter.

But even providers say sensors are too expensive even as a short-term measure, considering a COVID-19 vaccine would make social distancing tech redundant.

“Because we want people to have this technology, what we are charging only covers part of the cost it takes to provide it. This solution won’t be relevant a year from now, hopefully,” said Sonny Tai, co-founder and CEO of Actuate, a New York-based artificial intelligence software company.

For companies that cannot afford sensors and “sneeze guards,” there are low-cost options to keep workers safe. Instead of thermal sensors, companies can use thermometers and ask employees medical screening questions. And instead of cubicles, privacy panels can be a lower-cost alternative. But office consulting firms say that structural changes might not be necessary after all.

“Companies don’t want to look at the pre-vaccine period and make enormous investments. It is not the appropriate time because we need more information. We can use the existing work environment, following certain guidelines and inexpensive modifications,” said Learner.

‘People want to know that their employer cares’

When employees return to the office, they can expect fewer chairs and desks, with at least six feet of distance between them. Signs around the office will ask employees to walk in a single direction, like in many grocery stores. Many employers will also provide masks, hand sanitizers and wipes.

“From a re-imagination standpoint, that is a capital expenditure and required cost. But a lot of the things we’re talking about can be managed with relatively less expense,” said Sanjay Rishi, CEO of JLL’s Corporate Solutions in the Americas.

To encourage social distancing, businesses may stagger employees’ returns. Experts say that most businesses will initially reduce capacity to 50%, while some employees continue to work from home, at least part-time.

“In the short-term, keeping shifts of employees working from home allows them to remain largely net-neutral on the amount of real estate they have,” said Sylvester. “We suspect there will be a long, and potentially even permanent, period of alternating work schedules and optional work from home schedules.”

But some major new expenses will be necessary for most office suppliers: cleaning is going to be a particularly important part of workplace re-entry. Offices will need to be cleaned more often and more thoroughly — and companies will need to prove to employees that they are returning to a sanitized work environment.

“When it comes to cleaning, people want to know that their employer cares. At another time employees may not have felt that their employer did care, so it is more important now than ever,” said Jim Underhill, former CEO of Cushman and Wakefield and current CEO of Cresa, a Washington D.C.-based commercial tenant consulting firm.

Some companies are instituting ‘experience apps’ to communicate with tenants, according to Eddy Wagoner, executive director and digital chief innovation officer at JLL Technologies, while for others, seeing is believing.

“I spoke with a large company that is having the cleaners come in a half-hour before employees arrive, so they can smell the cleanliness. A lot of cleaning usually happens off hours,” said Kate Wieczorek, manager of workplace strategy at workplace consulting firm Ted Moudis Associates in New York City.

Sanitization expenses can get pricey, especially when installing new technology. Touchless options for doors, faucets, cafeteria check-outs and conference room check-ins — which can cost about $1,000 each — are already standard in many facilities, but health concerns will likely accelerate demand, according to Bryan Murphy, CEO of New York City-based flexible office provider Breather.

Plus, old heating, ventilation and air conditioning systems may need to be replaced if they are not providing clean air for employees. That could cost up to $10,000 or more, but ineffective air filters and dry air conditions can amplify risk, said Murphy.

“Customers are not looking for the cheapest cleaning service anymore — they want the healthiest office,” said Adam Povlitz, president and CEO of Anago Cleaning Systems, a Florida-based commercial cleaning company with over 40 U.S. franchise locations.

Getting to the office safely

But there is one immutable problem that employers don’t know how to solve: getting workers and employees to the office. Long commutes, especially on public transportation, pose health concerns. And the last bit of the commute, the elevator to the office, threatens to create unsafe conditions for employees. Most employers say they have not found a full answer to this problem, but they plan to limit the number of passengers on elevators.

“Most of the problem is not where it is safe to go into the office, but how do I get to work? How do I get through the lobby and the elevator?” said Learner. “The biggest obstacle right now is getting people up to their space with the capacity in the elevators. Might need to stagger start and leave times.”

Employers are thinking through every aspect of office life to adapt to a post-pandemic world. But as extensive as these changes are, they may not be enough to make employees want to return to the office.

In fact, some 74% of CFOs say their company will reduce office space because employees have adapted to working from home, according to a survey of over 300 CFOs by Gartner, a Connecticut-based research and advisory firm.

“Businesses are gonna realize they have way too much space to utilize and they’re going to want to renegotiate their leases,” Barbara Cordcoran, Shark Tank judge and founder of the Corcoran Group, a New York-based residential brokerage, recently told Yahoo Finance.

Shrinking demand could cause up to a 15% decline in office rent prices over the next 12 months, according to Murphy.

Sarah Paynter is a reporter at Yahoo Finance. Follow her on Twitter @sarahapaynter

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

More from Sarah:

Warren Buffett: Demand for office and retail space may drop 'fairly significantly'

Barbara Corcoran: Coronavirus pandemic is devaluing commercial real estate ‘overnight’

Landlords offer retailers some relief amid the coronavirus outbreak

money

money