Coronavirus stimulus: GOP plan would hurt low-income families most, experts say

If the GOP’s plan to reduce extra coronavirus unemployment benefits gets passed, lower-income American families will get hurt the most.

The Republican proposal released Monday suggests cutting the extra unemployment benefits to $200 a week through September and then ultimately transitioning to unemployment benefits that replace only 70% of wages.

That would replace the extra $600 in weekly benefits that expire on July 31.

“The $600 a week disproportionately benefits poor people and that is really a feature, not a bug,” said Martha Gimbel, manager of economic research at Schmidt Futures. “It was originally a bug, but it's turned into a feature where poor people are just more likely to spend.”

Read more: What to do before you lose your job

‘If consumers cannot spend, we are in a lot of trouble’

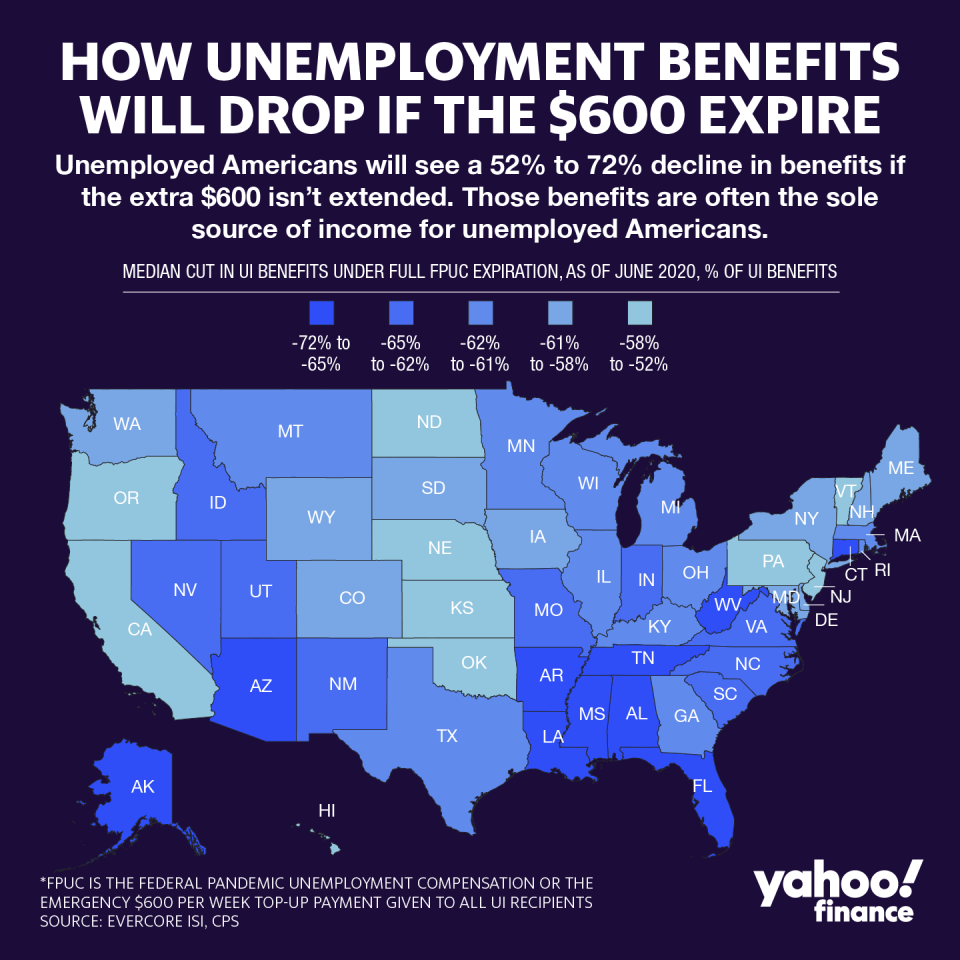

Under the GOP’s two-step plan, weekly benefits will first be cut to $200, which will mean a median cut between a third to a half for jobless Americans, according to an analysis by Ernie Tedeschi, a managing director and policy economist for Evercore ISI.

The second phase featuring the 70% wage replacement rate will slash benefits further, especially for lower-earning workers who benefited the most from the additional $600.

Read more: Do you have to pay taxes on unemployment benefits?

The extra $600 replaced 187% of income for the lowest-income households, while it replaced 88% for the highest-income households, according to a paper from Becker Friedman Institute at the University of Chicago.

That extra boost allowed poorer Americans to keep spending nearly as much as before the pandemic, while keeping up with their bills.

As of mid-July, low-earners spent just 2% less than before the COVID-19 outbreak, while the top quartile of earners spent 10% less, a paper from the Harvard-based Opportunity Insights group found. Missed payments on credit card bills, rent, and other obligations also remained lower than initially expected because of the support.

Read more: Everything you need to know about the extra $600 in unemployment benefits

“I see very little argument to pull consumer spending out of the economy at this time, which is what cutting unemployment insurance benefits would be,” Gimbel said. “The United States is a consumer-driven economy and if consumers cannot spend, we are in a lot of trouble.”

‘That deadline was this past weekend’

Another concern is the delay and implementation of benefits.

Until a deal is reached between both parties, jobless Americans will see a gap in receiving their extra unemployment benefits. Most states pay those benefits on weeks ending on Saturday or Sunday. That means July 25 or July 26 was the last time those workers got the extra $600.

“We're already at the point where people will likely see delays in distribution of benefits,” Gimbel said. “That deadline was this past weekend and we blew past it.”

Implementing a flat rate of $200 would take from one to five weeks, while the targeted option of a 70% wage replacement may take from eight to 20 weeks to get in the system, according to a memo from the National Association of State Workforce Agencies.

“People don't understand how complicated the unemployment insurance benefit calculations in states can be,” Gimbel said. “You're asking overtaxed systems to go in and do some pretty serious reprogramming.”

Some states struggled with just disbursing the additional flat $600 unemployment benefits under the CARES Act as they wrestled with reprogramming their computers that depend on a 60-year-old programming language.

States that can’t provide payment proportional to lost wages can apply for a waiver and continue paying the flat $200 for another two months.

“Asking systems to change horses in the middle of an avalanche is not going to help American families,” Gimbel said. “The important thing right now is to ensure continuity, so that workers can still feed their families and stay in their homes.”

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Rich Americans' pullback in spending is hurting the economic recovery

Remote schooling leads to a 'shocking' disparity between rich and poor students

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money