Goldman exec: Digital banking is here to stay with physical branches now 'a dinosaur'

Goldman Sachs' (GS) startup consumer bank has seen "tremendous tailwinds" in the acceleration of digital-only banking during COVID-19 lockdowns, with social distancing hastening consumer adoption of mobile banking.

Marcus, named after the 150-year-old Wall Street firm's cofounder, has benefited from trends amplified by the coronavirus crisis. According to a top Goldman Sachs executive, an uptick of mobile banking in the last three months has led nearly 40% of consumers planning to try it for the first time.

Digital banking “is here to stay, and physical branches are a dinosaur. They are a thing of the past,” Harit Talwar, the head of global consumer business for Goldman Sachs," told Yahoo Finance in an interview earlier this month. “Consumers don't want to visit them."

Talwar, who oversees the nascent digital-first consumer bank, stated that “more than a quarter of customers are saying that they don't want to visit branches any longer. So, I think the one trend very clear is the acceleration of digitization.”

Debuting four years ago, Goldman’s Marcus offers no-fee savings accounts with a 1.05% annual percentage yield (APY) that can be opened for as little as $1. Marcus also offers access to fixed-rate, no-fee loans of up to $40,000.

Like Apple and Amazon for banks

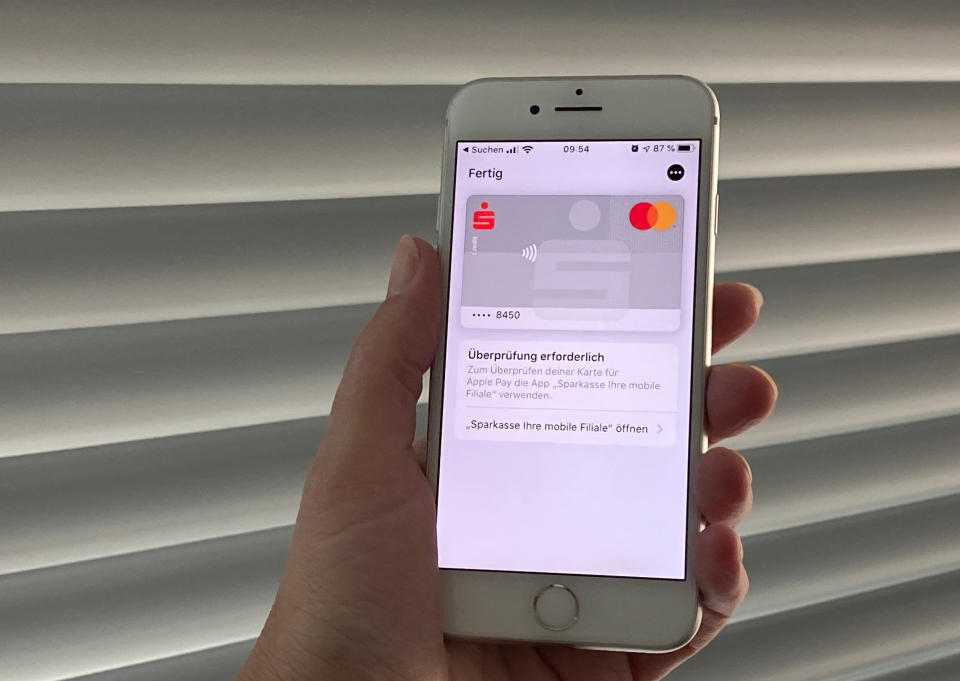

And last year, Marcus teamed up with Apple (AAPL) and Mastercard (MA) to release its first-ever digital and physical credit card called the Apple Card.

Those trends helped Goldman’s consumer banking business post revenues of $258 million in the most recent quarter — up 19% from the same period a year ago. During Q2, consumer deposits grew by $20 billion to $92 billion. The bank ended the quarter with $7 billion in loan balances, with about $2 billion from the Apple Card and $5 billion from Marcus’ loan business.

"Our savings and deposits business has grown tremendously in the first half of this year, and it has grown because we offer a competitive rate, but more importantly, or equally importantly, we make it simple and transparent," Talwar said.

He noted that more than 90% of Marcus accounts open without any human involvement, but a person is there if a customer wants that interaction.

Clients “like the easy flow of digitization. So we do believe, as a disruptor, we can do to financial services what Apple did to music, what Amazon (AMZN) has done to retailing, which is innovate the distribution and consumption experience, keeping the customer at the center of everything."

As the pandemic wrecked the economy and jobs, Goldman's consumer bank rolled out a deferred payment option for Marcus loans and the Apple Card. From the time Goldman made that decision to create its customer assistance plan, it rolled out the offering digitally within 72 hours.

"It was digital-first, and consumers really appreciated the fact that they can do this without going through hoops and hoops with other banks and long call wait times. They can do it at the click of a button. They can talk to us if they wanted, but an overwhelming majority enrolled digitally," Talwar explained.

He added that many customers that opted into the deferred payment plan still made their payments on time.

"What we are seeing is that customers are concerned about whether they will have the ability to make the payment or not, but a large number of them are still having the ability to make the payment."

Julia La Roche is a Correspondent for Yahoo Finance. Follow her on Twitter.

Palihapitiya: Skip government bailouts, put ‘more money into the hands of consumers’

Gundlach: A wave of layoffs is coming for $100,000/year white-collar jobs

Gundlach sounds off on prospects of a V-shaped recovery as ‘highly optimistic’

Gundlach lashes Fed’s ‘incredible fiscal spending’ during coronavirus collapse

Gundlach: Why the dollar and tech rally are ‘real risks’ for investors

money

money