We’re eating a lot more pizza during the pandemic. Why Domino’s is getting the biggest slice of the pie

Our mission to help you navigate the new normal is fueled by subscribers. To enjoy unlimited access to our journalism, subscribe today.

Once a week Brandi Johnson finds herself peeping through her red curtains, on the lookout for her favorite delivery—the one that means she doesn’t have to cook dinner. When the driver pulls around the corner and stops in front of her apartment, she runs upstairs to look out another window, this time to make sure the box is placed outside her front door.

Like many Americans during quarantine, Johnson has been ordering a lot of pizza.

“Pizza is the perfect comfort food for me—not too messy, hard to mess up, good whether it’s hot or cold, and I don’t need silverware,” says Johnson. “It’s just a perfect guaranteed meal to have during such uncertain times.”

Top pizza chains have benefited from the cravings of customers like Johnson. Papa John’s, for instance, reported that sales at its North American restaurants saw a 28% increase in the second quarter compared with the year before, with three straight months of double-digit gains. To keep up with that skyrocketing demand, the company said that it had hired 20,000 additional employees between March and June—and plans on hiring 10,000 more. As of early August, shares of Papa John’s had spiked some 55% this year, after a couple of years of underperforming.

Yum Brands’ Pizza Hut, which has been battling falling sales over the past few years, had its best week for delivery and carry-out sales in eight years in early May. The uptick in pizza delivery was a bright spot for Yum Brands—whose portfolio includes Taco Bell and KFC—in a quarter in which overall sales fell 15% worldwide.

“Pizza Hut’s off-premise business was up 21% in 2Q, and for a business that has underperformed over the last few years, the performance suggests there is a material industry-specific component to the pizza category’s share gains,” says Credit Suisse analyst Lauren Silberman.

But no delivery operator has benefited more from America’s increased appetite than Domino’s Pizza.

The largest pizza company in the world by sales, Domino’s had the biggest slice of the U.S. market coming into the pandemic. According to Bloomberg Intelligence, last year Domino’s captured 19% of total pizza sales in the U.S. thanks to its dominance in delivery. The company gobbled up a whopping 36% of U.S. delivery sales in 2019 versus a combined total of 26% for other major chains. (Regional chains and independent restaurants garnered 38%.)

As with its pizza peers, the company’s sales have spiked in recent months. In July, Domino’s reported that its U.S. same-store sales increased by 16% in the second quarter of 2020 and earnings per share leapt to $2.99 from $2.19 in the same quarter last year. Domino’s generated $240 million in net income through the first half of 2020, a 30% increase over last year, despite slower growth in international markets.

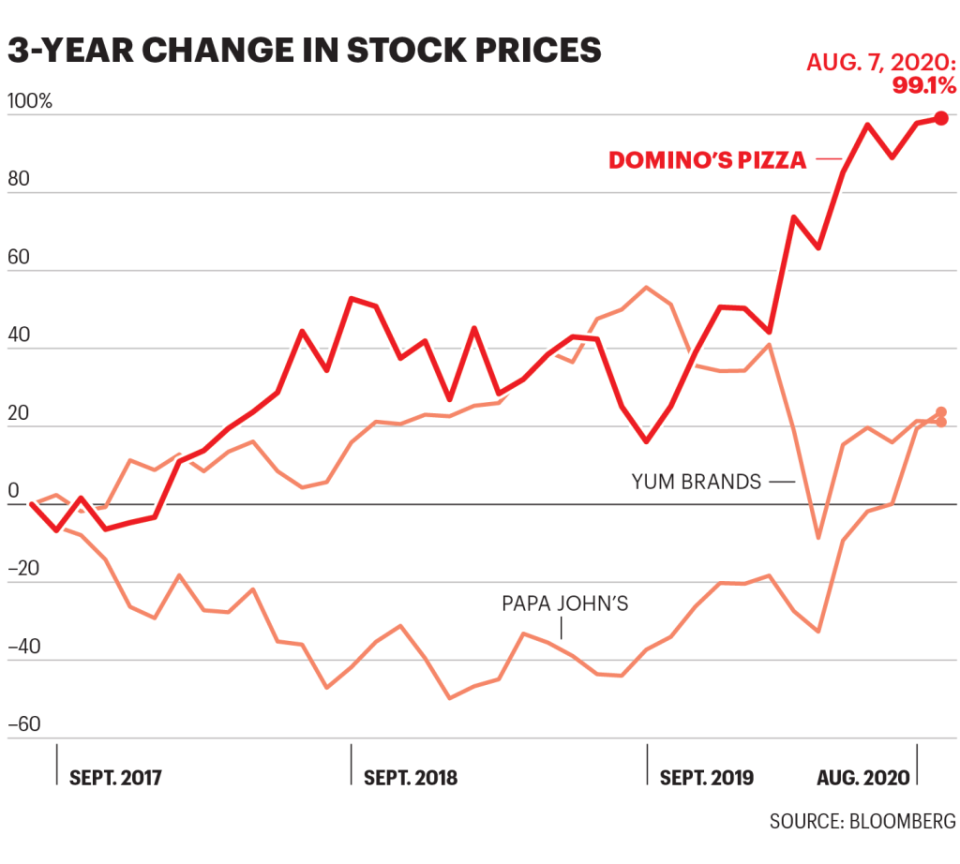

Shareholders of Domino’s have been well rewarded. Through the first week of August, the pizza giant’s stock was up 24% in 2020. And that’s on top of years of strong returns. Over the past three years, Domino’s stock has risen 99%—easily outpacing its pizza peers.

Analysts say that Domino’s was uniquely positioned to meet consumers’ increased demand for pepperoni-and-cheese–topped comfort food thanks to its commitment to innovation over the past several years.

“Domino’s has outperformed the industry over the last decade given its strong execution, which has allowed it to gain share from smaller competitors and Pizza Hut,” Silberman says. “Domino’s has an industry-leading digital and delivery infrastructure, which we view as the most powerful asset it has.”

Domino’s long-term investment in advancing its delivery capabilities and rehabbing its public image has paid off in a big way. When former Domino’s CEO Patrick Doyle was promoted in 2010 from his role as president of the company’s domestic retail operations, the company’s stock was trading at about $9 a share, and customers complained that the crust tasted like cardboard. The sauce? Like ketchup. Domino’s went on a mission to improve its reputation and, under Doyle’s leadership, to perfect delivery. When Doyle stepped down in 2018, Domino’s price per share had risen to more than $250, and its market value had increased by an astonishing $11.2 billion.

“When you consider the three big players in pizza, they are already an expert in delivery because the pizza industry has been using this model for decades,” says Shan Li, a professor at the Zicklin School of Business at Baruch College. “But Domino’s is the only one to rely on their own capabilities to deliver food to customers instead of working with a third party [such as Seamless or Uber Eats].”

Today, Domino’s technology leads the pack. Customers don’t have to be at a specific address to get their favorite pie—Domino’s rolled out hotspot locations in 2018, which allows people to get their pizza anywhere, from the beach to a stadium parking lot. The Ann Arbor–based company also introduced the dinner bell function in 2018. Using the mobile app, customers can create groups of their friends and family and the app will automatically “ring the bell” when their order is out for delivery.

There is another fundamental difference in how Domino’s does delivery compared to its rivals—one that allows it to maximize profits. While many Pizza Hut and Papa John’s stores deliver their pizzas directly to customers, those chains have also paired up with third-party delivery services in order to reach more customers. In 2019, Papa John’s partnered with DoorDash, while Pizza Hut has a similar arrangement with Grubhub. Local pizza chains are especially reliant on third-party operators. By contrast, Domino’s relies solely on its own delivery infrastructure.

Third-party delivery services allow local pizza places to scale up their delivery volume, but it comes at a cost. Uber Eats, for example, charges restaurants a fee equal to 30% of the order to deliver to their customers. So although mom-and-pop pizzerias may be getting more orders, that doesn’t always lead to a profit increase; with the costs of staying open and few dine-in customers, many small businesses are just hoping to break even. According to financial services firm BTIG, while Domino’s franchisees pay $0.25 per online sale, small businesses are charged $2 or $3 for a similar transaction by third-party operators.

The Nickerson family in Indian Harbour Beach, Fla., has been doing its part to keep their local pizza places busy. Since Caroline, 26, moved back home with her parents two months ago, they’ve been ordering pizza at least three times a week, all from restaurants within a three-mile radius of their home.

“I think we’re all stressed, so it’s also the first thing we think of,” Caroline Nickerson says. “Under normal circumstances, we wouldn’t be ordering so much pizza. We’d go out to eat at different restaurants, and we’d be living in separate houses.”

Nickerson planned to move to Philadelphia for a job, but when the opportunity went remote, she decided to move home. As the coronavirus pandemic drives millennials back home and forces families to juggle work and childcare, many households are turning to pizza for a quick, low-cost option, says Li, the Baruch College professor.

“From the budget perspective, many consumers have found themselves with smaller budget constraints due to the pandemic,” says Li, whose go-to order is California Pizza Kitchen’s Thai pizza. “To some extent, pizza is just one of the best options for many of us to feed a family at a lower cost.”

Riding the spike in demand, pizza chains must now find a way to keep these new customers. Papa John’s answered with its new flatbread sandwich, the Papadias, in February. And Domino’s rolled out a new recipe and sauces for chicken wings in July. Typically the most profitable menu item for a pizza company is still pizza, analyst Silberman says. But smart menu additions and sides, in particular, can help increase the average check and lead to more profit.

While experts don’t know how long the pandemic pizza boom will last, Li says consumer behavior will be altered by pandemic concerns for a long time. For instance, online grocery shopping, which has grown very slowly over the past 20 years, suddenly experienced huge growth over the past few months, according to a survey conducted by Brick Meets Click and Mercatus. People have adjusted to the new ease of ordering, Li says, and will stick to their new habits of using platforms like Instacart.

“People will not go back to their pre-COVID lives overnight,” she says. “I think this shift in consumer behavior and the impact of the pandemic is going be long-lasting and profound.”

And, perhaps, pizza-fueled.

More must-read retail coverage from Fortune:

Why teaming up with Amazon makes sense for top U.S. mall owner Simon

Zoom and face masks are giving cosmetics brands an eye lift

Why Nestlé’s CEO has been in the office every day since COVID-19 hit

Commentary: Fashion businesses are no longer a worthwhile investment

Why REI is putting its brand-new Bellevue HQ on the market

This story was originally featured on Fortune.com

money

money