Democrats: Homeowners need to know about forbearance protections amid coronavirus

Democratic lawmakers are urging mortgage servicers to notify American homeowners of their forbearance protections, according to a series of letters obtained by Yahoo Finance.

Senators Elizabeth Warren (D-MA), Sherrod Brown (D-OH), Kyrsten Sinema (D-AZ), Jack Reed (D-RI), Bob Menendez (D-NJ), Brian Schatz (D-HI), Catherine Cortez Masto (D-NM), Tina Smith (D-MN), and Chris Van Hollen (D-MD) called on servicers to inform homeowners of the protections present in the CARES Act, which include payment deferrals up to a year based on coronavirus related hardships for those with federally backed mortgages. (The legislation also prohibits a lender or loan servicer from foreclosing on an eligible homeowner for a period of no less than 60 days, beginning March 18, 2020.)

“[I]t is incumbent that your company do your part to affirmatively and accurately inform consumers of their ability to request forbearance under the CARES Act if they are facing hardship, and to ensure that families who need assistance and are unable to pay their mortgage because of COVID-19-related financial hardship are able to remain in their homes,” the lawmakers stated. “Homeowners face an unprecedented public health and economic emergency, and must have guaranteed, easy access to the protections provided to them by the CARES Act if they need them.”

The letters were sent to Wells Fargo, JPMorgan Chase, Mr. Cooper, Bank of America, PennyMac Loan Services, Quicken Loans, Freedom Mortgage, New Residential, Lakeview Loan Servicing, US Bank, and Truist.

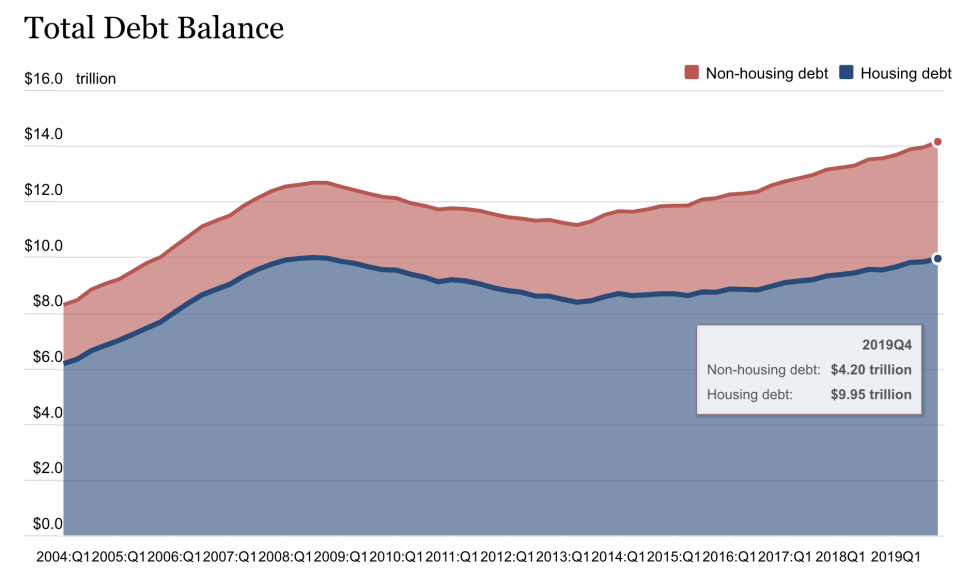

Mortgages form a massive part of Americans’ household debt. Currently, the average American household has $203,296 in mortgage debt, according to Experian. That debt also happened to be a key catalyst that led to the Global Financial Crisis in 2009.

The Senators asserted that the guidance given thus far has been lacking. For instance, they noted that the Consumer Financial Protection Bureau (CFPB) — created in the wake of the financial crisis — has suggested that consumers “can call your servicer” to figure out “who owns or backs your mortgage.”

In reality, the servicers haven’t been able to keep up with the demands of borrowers. Recent data by the Mortgage Banking Association showed that mortgage forbearance requests had increased by 1,896% between March 16 and March 20. Experts say there is a misunderstanding between servicers and borrowers of what the guidelines entail.

“My servicer The Money Source still insists on lump-sum payments after the forbearance and does not acknowledge the option to defer,” an anonymous New Jersey resident who has a federally-backed mortgage told Yahoo Money. “I’ve escalated this up to a manager and they hide behind the FHA excuse.”

Warren, Brown letter to mor... by Aarthi on Scribd

The senators inquired whether the mortgage companies have taken steps to “proactively notify all homeowners” they service about forbearance and foreclosure relief options. Questions (paraphrased) include:

If eligible homeowners miss or are late on payments during the period they are eligible for forbearance, will the company contact them with information regarding their availability for forbearance? Furthermore, how far after a missed or late payment would this be?

Would the communications be available in languages other than English to assist those that need assistance?

Current steps the companies have taken to ensure compliance with the foreclosure moratorium under the CARES Act, and to confirm that they haven’t initiated any foreclosure processes, judgement or evictions.

How are they ensuring that borrowers who enter forbearance won’t be charged interest, fees or penalties — and what scripts customer call line operators are following to discuss forbearance with borrowers?

Dhara Singh and Aarthi Swaminathan are reporters at Cashay and Yahoo Finance. Follow them on Twitter at @Dsinghx and @aarthiswami.

Read more:

Mortgage refinances hit 11-year high as coronavirus fears send rates tumbling

Google search for ‘Should I buy a house’ is at all-time high

Read the latest financial and business news from Yahoo Finance and Yahoo Money

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money