Student loan expert on mass debt cancellation: ‘We don’t need these blunt solutions’

The coronavirus pandemic and accompanying financial crisis is putting particular pressure on the finances of student loan borrowers and on Congress to do something about a “broken” system.

Democrats have recently proposed mass debt cancellation ranging from $10,000 to $30,000 to help borrowers, while most Republicans and some experts argue that a broad student loan forgiveness plan is not the right approach.

Read more: How to repay student loans: The full breakdown

About 44 million borrowers across the country hold more than $1.6 trillion in student loan debt.

“Most of it is actually pretty good debt,” Jason Delisle at the American Enterprise Institute told Yahoo Finance’s YFi PM (video above). “People have the means to pay, they are paying … somewhere around 40 to 50% of the outstanding debt … paid for graduate degrees.”

A Center for American Progress study from January stated that graduate programs enroll only 15% of all students in higher education, while they account for 40% of the federal student loans issued each year. Between 2010-11 and 2017-18, the study found, graduate student loans grew by 7% as undergraduate student loans falling by 21%.

So “if you’re doing a blanket loan forgiveness,” Delisle added, “you’re gonna be forgiving loans for people who are some of the most ‘educationally elite’ in this country. We’re on the right track with programs in place … we don’t need these blunt solutions like forgiving all debt.”

‘Educationally elite’ not immune to historic job losses

2020 may have changed the dynamics a bit.

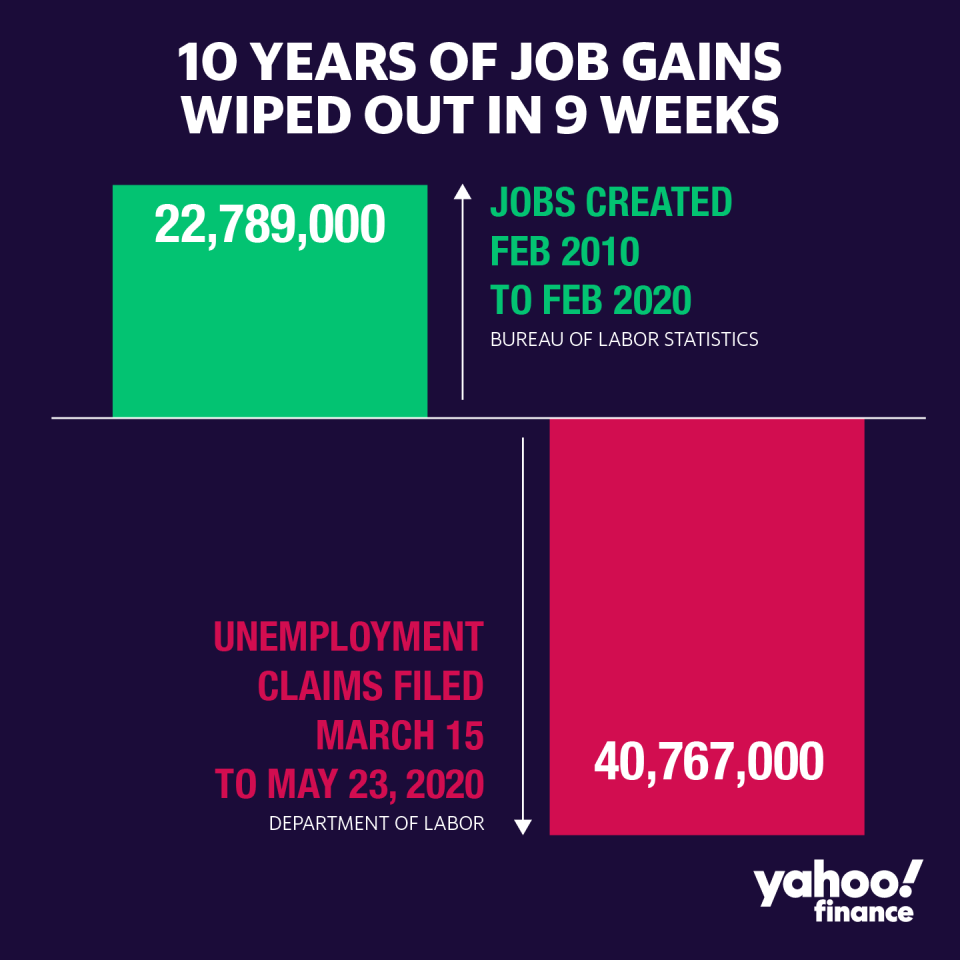

Student loan borrowers with master’s and doctoral degrees — the so-called ‘educationally elite’ — are not exactly immune to unemployment amid the worst job losses since the Great Depression.

Data from the Federal Reserve Bank of St. Louis shows that while the unemployment rate for people above the age of 25 without a high school diploma has been the highest at nearly 21%, 6.7% of those holding a master’s degree and 3.2% of those with a doctoral degree are unemployed as of April 2020.

Underemployment is another separate issue. Data from Experian on the unemployment rate suggests that as the underemployment rate spiked in April, from 8.7% to 22.8%, more workers transition to part-time roles. The data does not break out the underemployment rate for masters and doctoral graduates.

Also noteworthy is the fact that there are stark racial disparities within that ‘educationally elite’ group. Black or African American graduate students hold the most amount of federal student loan debt, with the median total number standing at $76,750. In contrast, white graduates’ median total federal debt stands around $44,694.

Cancel student debt, then what?

Delisle argued that despite the dysfunction in the system — such as a major student loan servicer’s mistake that hit 5 million student loan borrowers’ credit reports — overhauling the entire system isn’t the best way forward.

And for people who will struggle to make payments after congressionally mandated protections halting interest payments are lifted, he added, they can use income-based repayment plans so that “if you need extra time to get on your feet and get through this soft job market, those benefits are there.”

Aarthi is a reporter for Yahoo Finance covering student debt and higher education.

Read more:

Student borrowers sue over ‘illegally damaged’ credit scores amid coronavirus pandemic

Student loan borrowers sue Betsy DeVos and Steven Mnuchin over seized tax refunds

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

money

money