Crypto gains may be fueling the labor shortage as people buck low-paying work and take their chances on risky digital assets, research firm says

Cryptocurrency gains may be fueling the persistent labor shortage in the US, a new study found.

A number of Americans have given up their full-time jobs to take their chances on risky digital assets.

The study was conducted by CivicScience, a research firm.

The gains from cryptocurrency trading may be fueling the persistent labor shortage in the US as Americans across the income spectrum gave up full-time jobs to take their chances on risky digital assets, a new study shows.

The study was conducted by research firm CivicScience, which surveyed thousands of respondents in the US in October.

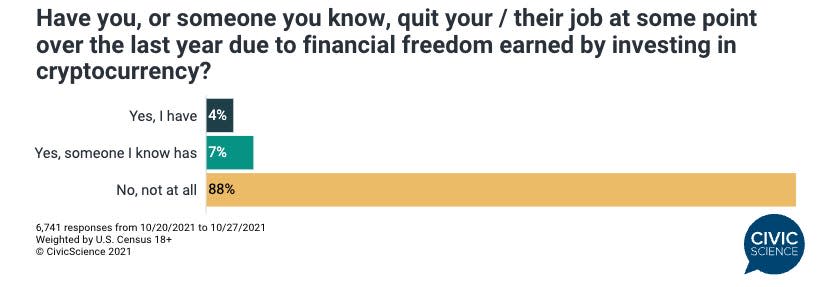

One finding showed that around 11% said they or someone they know have resigned from their jobs due to the financial freedom afforded by digital asset trading. The survey comes as the total market cap for digital assets just hit $3 trillion for the first time on record, roughly the size of the entire UK economy.

The numbers are more dramatic when dissecting the responses by income. The chart below illustrates how a sizable portion of those who quit their jobs thanks to their crypto investments come from the lowest income brackets.

"This data implies that crypto investments may have provided life-changing levels of income for some, while the wealthier owners of crypto use it more as another form of asset diversification rather than a source of income," the study said.

Data also showed that of those who invested in crypto, 23% said they did so as a short-term investment, 28% for the long term, 16% did it because it was simple and easy, while 12% said it was their hedge to any economic downturn.

The overall sentiment seemed to be positive though. Nearly 60% of respondents declared they are wealthier than they were last year, or at least have the same level of wealth.

The results may not come as much of a surprise as more people turned to retail trading — both in equities and cryptos — during the height of the pandemic to stave of pandemic-lockdown boredom and to spend their multiple rounds of stimulus checks.

But multiple regulators and legislators have sounded alarms about the "gamification" borne of commission-free trading on popular apps such as Robinhood.

For instance, US Securities and Exchange Commission Gary Gensler in May has expressed concern that apps are increasingly using features like points, rewards, leaderboards, bonuses, and competitions to boost user engagement, he said.

Read the original article on Business Insider

money

money