Credit card rates keep going up, and Americans are getting trapped

The Federal Reserve may be lowering federal interest rates again these days, but credit card interest rates are rising.

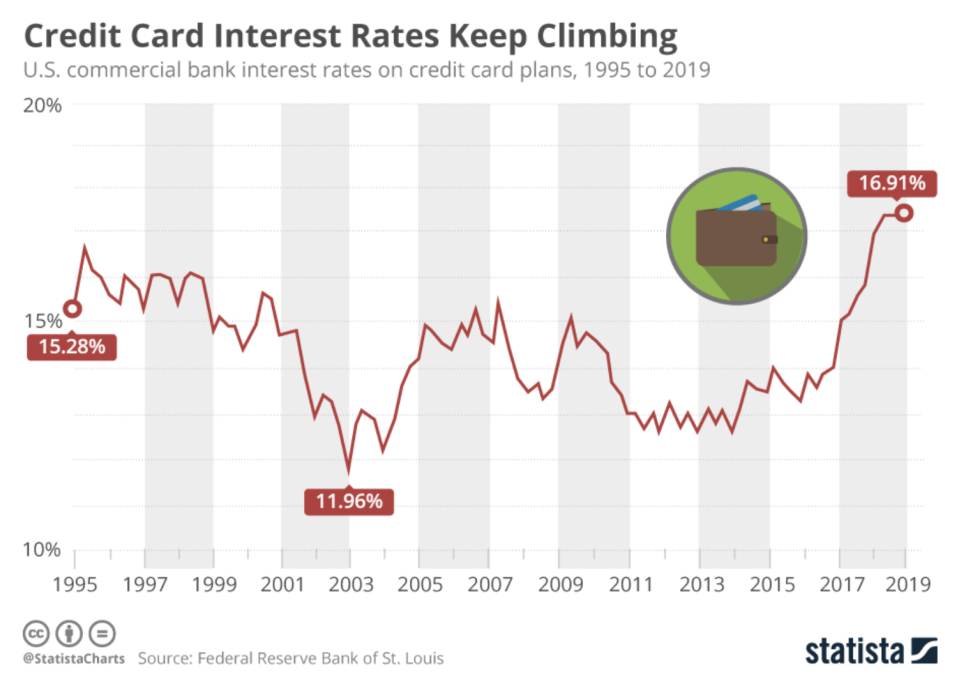

Credit card interest rates increased 3.4 percentage points since 2015, according to data from the Federal Reserve of St. Louis, and have been rising since 2011.

And for Americans carrying credit card balances month over month, therein lies the trap: While consumer confidence hit an 18-year high in September 2018, credit card interest rates hit a 25-year high.

And those rates haven’t gone down since (while consumer are starting to feel the pain from the ongoing trade war).

Credit cards amounted to a nationwide debt of $870 billion in the second quarter of 2019, according to the Federal Reserve data, which was a $20 billion increase from the first quarter of the year. On average, the American household carried a $6,028 credit card balance.

Millennials are carrying an average of $4,712 in credit card debt as of Q1 2019, according to Experian data.

To illustrate how that rate affects Americans every day, consider the following:

Today’s current credit card interest rate of 16.91% means an additional $796.80 in annual interest on the average $4,712 millennial card balance.

If you pay off that balance over five years, the total interest paid is $3,984, in addition to the principal.

Annual interest on a $4,712 balance has gone up by $137.12 since 2016.

To comply with the Credit Card Accountability Responsibility and Disclosure Act of 2009, which made it illegal for lenders to hike interest rates on existing balances, lenders now bake in the interest upfront. Consequently, high interests rates are everywhere when consumer look for credit cards.

‘Getting the best rates possible on your existing debt’

Carrying a balance of any size isn’t the savviest financial move. But if paying off your balance in full isn’t an option, there are ways to mitigate the pain.

Chris Burns, an Atlanta-based certified financial planner, told Yahoo Finance that consumers could use their good standing credit to sidestep high interest rates.

“Getting the best rates possible on your existing debt” is key, Burns said, and he advises to find “a balance transfer to a credit card with a lower rate or a special offer like 0% for 12 months.” Homeowners have another set of options, such as applying for a “home equity line of credit to pay off all your credit cards.”

If you’re lacking a favorable credit score, another move is to shop around for reputable online lenders offering a lower rate debt consolidation.

Stephanie is a writer for Yahoo Finance. Follow her on Twitter @SJAsymkos.

Read more: The Amazon rainforest is burning — here's how you can help save it

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money