Cracking Under Pressure: Inside the Race to Fix France’s Nuclear Plants

(Bloomberg) -- Behind layers of security and a thick concrete wall, a team of welders work in shifts to fix the crippled Penly nuclear plant in northern France. Sweating under protective gear, they’re replacing cracked pipes in the emergency cooling system which protects against a reactor meltdown.

Most Read from Bloomberg

Adani Tries to Calm Investors With 413-Page Hindenburg Rebuttal

Adani Rout Hits $68 Billion as Fight With Hindenburg Intensifies

Historic Crash for Memory Chips Threatens to Wipe Out Earnings

Each weld takes at least three days to complete, with workers often on their knees or backs to reach for the correct angle. Even in radiation suits, health regulations limit work in that environment to a maximum 40 hours a year.

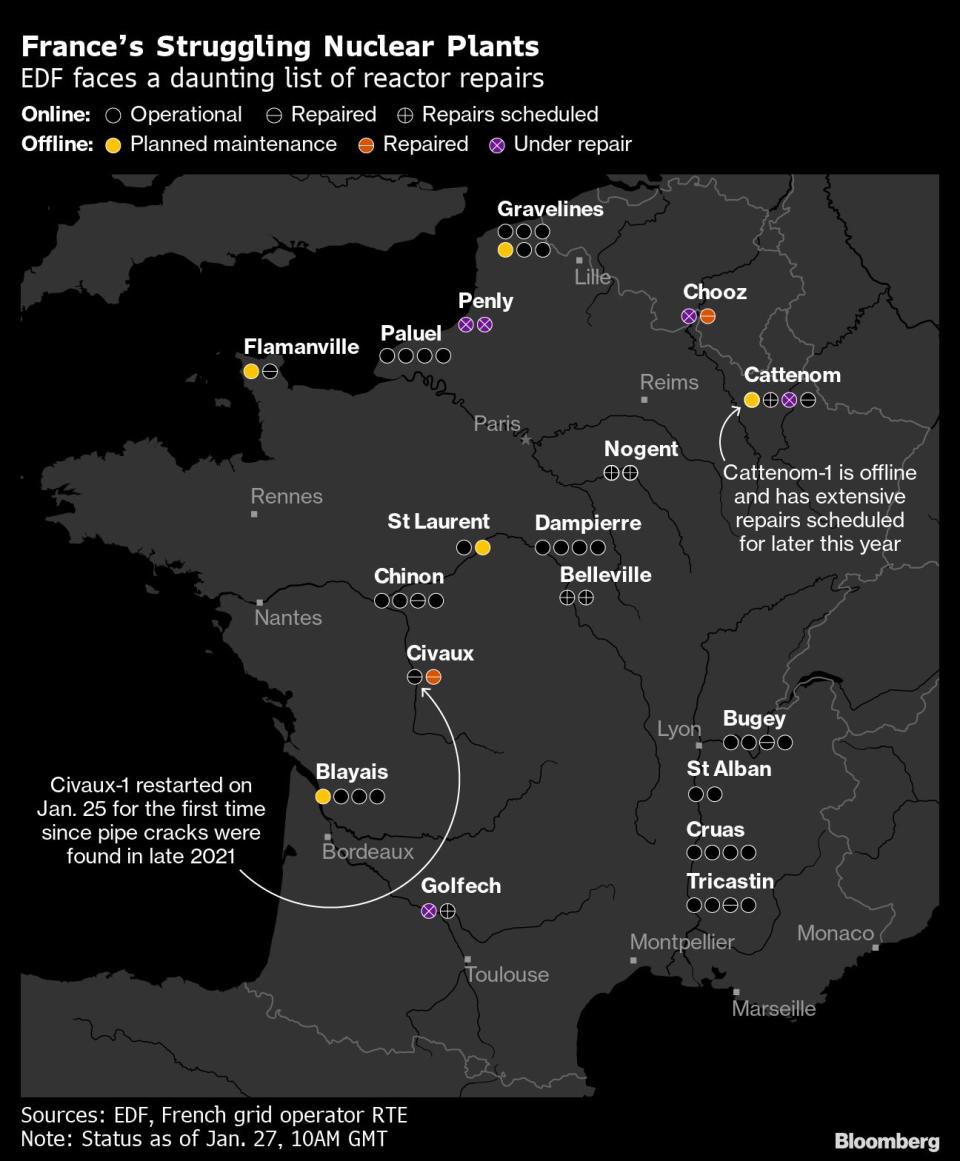

The complicated procedures, replicated across sites this winter, have hampered the ability of Electricite de France SA to get its reactors back online after lengthy shutdowns.

Deadlines have slipped. The two Penly reactors were scheduled to be back online this month and next. Instead, EDF has been forced to delay the restarts to May and June.

“These are complex situations, in a noisy and radioactive environment,” Laurent Marquis, a manager at Altrad Group-Endel which is coordinating the repairs for EDF at Penly, said last month, before the restarts were pushed back. “Workers can sometimes only hold their position for just a few minutes before they need to be replaced.”

The power station, below a cliff on France’s northern coast, normally provides electricity for about 3.6 million households. Its two reactors have been, in effect, grounded by faulty plumbing — the same cracked pipes first discovered by EDF at another plant in late 2021. That reactor, at Civaux in central France, only came back online on Wednesday after extensive repairs.

The discoveries plunged the operator into a crisis with repercussions for all of Europe. EDF called it an “annus horribilis,” and from early May to late October, about half of its 56 reactors sat idle due to the repair and maintenance backlog.

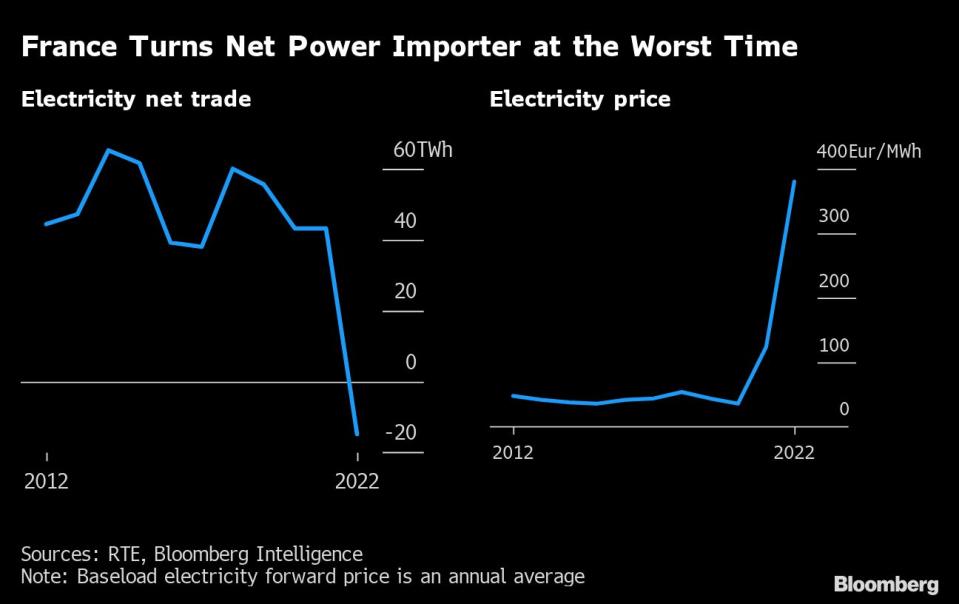

It flipped France from Europe’s biggest electricity exporter into a net importer last year, just as the continent needed it more than ever. After gas imports from Russia dried up, energy prices soared, governments spent billions helping consumers with their bills and Europe was threatened with shortages and blackouts.

So far, Europe has avoided the worst-case scenario, thanks to efforts to conserve energy and a relatively mild winter that reduced heating demand.

But the crisis is far from over, and EDF needs to find a way to avoid a repeat next winter. That challenge — finding problems, fixing them, doing checks — is already a mammoth task, and it’s being compounded by financial issues and staff shortages.

“We’re not out of the woods in terms of security of supply,” said Nicolas Goldberg, a senior manager in charge of energy at Colombus Consulting in Paris. “Don't expect miracles this year, some outages will sometimes be prolonged as unexpected things can be found during maintenance.”

The trouble started when EDF’s Civaux-1 reactor — which was only commissioned just over two decades ago — was undergoing a 10-year inspection. Ultrasound machines found signs of defects near the elbow or bend on pipes in the cooling system that didn't fit the classic profile of thermal fatigue. The utility had no choice but to cut the 3-centimeter thick steel tubes to examine them, and was then confronted with a disturbing discovery.

A section of the pipe was damaged by so-called stress corrosion, a phenomenon that's well known in the oil and gas and other industries but extremely rare in the atomic sector. Suddenly, EDF was scrambling to find the cause of the unexpected faults.

From December 2021, EDF extended its checks and progressively halted more than a dozen units for lengthy inspections, only to find more signs of stress corrosion.

Reactors are regularly taken offline without any major impact; EDF typically shuts down about 40 of its reactors every year for anything from short-term refueling to a partial inspection or long-term maintenance. But the additional halts caused chaos.

Output from France’s nuclear plants — which typically represent about 70% of the country's electricity production — dropped to 279 terawatt-hours last year from about 361 TWh in 2021. The utility estimates it will recover to 300-330 TWh in 2023, but that still means France may keep importing power for a significant part of the year.

The lower output is expected to deliver a €32 billion ($35 billion) hit to its 2022 results, compounding the utility's financial problems. The French government, which already owns 90% of EDF, is trying to fully nationalize the company to help put it on a more secure footing.

In France, the controversy surrounding EDF led to a war of words between President Emmanuel Macron and Jean-Bernard Levy, who was EDF chief executive until late last year. Levy said government talk about closing reactors made it harder to hire, leaving the company short of key workers, something that Macron has called that an “unacceptable” excuse.

The president and many of EDF’s critics see the issues as proof the operator had been resting on its laurels, with its aging plants plagued by longer shutdowns and its new builds facing cost overruns and delays.

But for the French consumers and companies that rely on EDF’s power, the pressing problem right now is getting the country’s nuclear engine back up to speed.

Inside the 40-meter high Penly reactor buildings, that means cutting tens of meters of pipe, preparing spare parts ordered from Italy and checking their length. Fittings are tested to make sure they can support the installed tubes. And when the welding begins, ultrasound images are taken every night to ensure the next layer of metal in the repair can be added. Since finding corroded pipes at Civaux-1, EDF has been analyzing parts in a special laboratory.

“It’s a phenomenon that was unexpected, which means we didn’t entirely understand it,” said Julien Collet, deputy director general of France’s nuclear safety agency. “Immediately, you wondered about its magnitude, and whether other reactors are affected.”

By May, the utility had concluded that 16 of its reactors had pipes more prone to stress corrosion. Significantly, they were actually the group’s newest reactors, where the French nuclear plant builder Framatome — a unit of EDF — had modified the original Westinghouse Electric Co. design used for the 40 older units.

Among other changes, the new layout made four safety water injection lines more sinuous — more twists and bends — making them vulnerable. With winter and the threat of blackouts looming, firms working on repairs had to fly in extra workers to try to meet deadlines.

Framatome and Westinghouse brought in about 100 specialist welders from North America, on top of the 500 metal workers and engineers available locally. That was a “no-brainer, given the stakes,” Framatome CEO Bernard Fontana said at a parliamentary hearing in December.

At Civaux, EDF set up a designated workshop for welders to practise, according to Sebastien Le Jan, a team leader at Onet Technologies who oversaw repairs on the No. 1 reactor.

Onet had to poach teams from other sites and find volunteers willing to postpone holidays.

“Everyone knew that we had to succeed as soon as possible,” Le Jan said in an interview.

It wasn’t just a manpower issue. Tools had to be adapted to operate in tight spaces, with welders using mirrors to work on piping too close to walls, while scores of dossiers were compiled to secure regulatory approval to replace tubing in record time.

Similar scenes played out elsewhere including at Chooz and Cattenom in northeast France.

Of the dozen reactors where pipes were cut for checks, EDF found no sign of cracking in three of them, while two had cracks caused by welding defects where tiny portions of metal had been insufficiently melted.

But in the majority, EDF did find stress corrosion causing cracks as deep as 6 millimeters on pipes.

Under fire for the 2022 chaos, EDF is trying to get ahead of further potential problems.

It plans to replace emergency cooling system piping in seven reactors as a preventative measure during planned halts of 160 days, starting this spring. The aim is to avoid doing weeks of checks only to find the pipes need replacing anyway.

Having initially fallen behind schedule, EDF is confident it has the labor, spare parts and supply chains in place to complete the repairs in time for next winter. The company says it’s also improved its inspection equipment so that it won't need to cut more pipes to determine the size of new cracks.

Not everyone is convinced. EDF has a history of missed maintenance deadlines, which an external audit published in June blamed on inadequate management of data, staff shortfalls and inexperienced teams in charge of turnarounds.

Read More: French Power Output Plunges With EDF Hit by Striking Workers

The company is still trying to figure out the speed at which cracks progress through pipes once they appear, meaning it faces tighter, more frequent monitoring of its reactors. Future setbacks can’t be ruled out.

The plan to fix seven safety cooling systems in 2023 is “not the end of the story,” Cedric Lewandowski, EDF’s senior executive vice-president for nuclear and thermal production, said at a parliamentary hearing this month. “It’s possible that we have to carry long and complex works. I think that 2023, ’24 and ’25 will continue to entail issues related to the stress corrosion.”

If that caps nuclear output, that means less power for France, and less to export to Europe.

Compounding the pipe issues is the broader maintenance work needed on what’s an aging fleet. Most of EDF’s reactors were built from the late 70s to the mid-90s, and now require longer down time. The utility wants to coincide the corrosion repairs with the other halts to maintain production, Lewandowski said.

On top of that, the utility is still repairing 122 faulty welds at a new flagship reactor in Flamanville in Normandy, which it wants to commission in the first half of 2024. The project is already over a decade behind schedule, and about €10 billion over budget.

All of which raises significant questions for EDF and the French government. Macron, despite his initial reservation about the nuclear industry's future, decided last year to boost atomic output alongside swathes of renewable energy to curb reliance on fossil fuels. He’s also planning to pay €10 billion to fully nationalize the utility.

Read More: French Nuclear Industry Plans Hiring Drive for New Reactors

France is not alone; 12 years on from the Fukushima disaster in Japan, the world is shifting back toward atomic power as governments try to improve energy security after Russia’s invasion of Ukraine.

Macron’s government wants to help EDF build six new large reactors and begin preparatory studies on another eight units by 2050.

But building 14 new reactors is “absolutely not within EDF’s reach with its current balance sheet,” said Celine Cherubin, a senior credit officer at Moody’s Investors Service. Beyond the full nationalization, a more favorable regulation for EDF may still be needed to help it meet its investment needs, she said.

EDF is also trying to restore its technical credibility, coming up with a new version of the reactors it is building in the UK and France that have been dogged with cost overruns.

The bigger question is whether EDF and the government can now reverse the sense of decline in France’s nuclear industry.

“This nuclear fleet is a strength, it’s our independence,” Sophie Mourlon, head of the energy directorate at the Energy Transition Ministry, said at a nuclear conference in Paris in October. But when it’s not working properly, “it’s also our Achilles’ heel.”

--With assistance from Samuel Dodge and Patricia Suzara.

Most Read from Bloomberg Businessweek

After 30 Years, the King of ETFs Faces a Fight for Its Crown

The US Hasn’t Noticed That China-Made Cars Are Taking Over the World

From ‘the Coin’ to High-Interest Bonds, the US’s Debt-Limit Options Aren’t Great

Even $370 Billion in US Incentives Won’t Solve All of Solar’s Struggles

©2023 Bloomberg L.P.

money

money