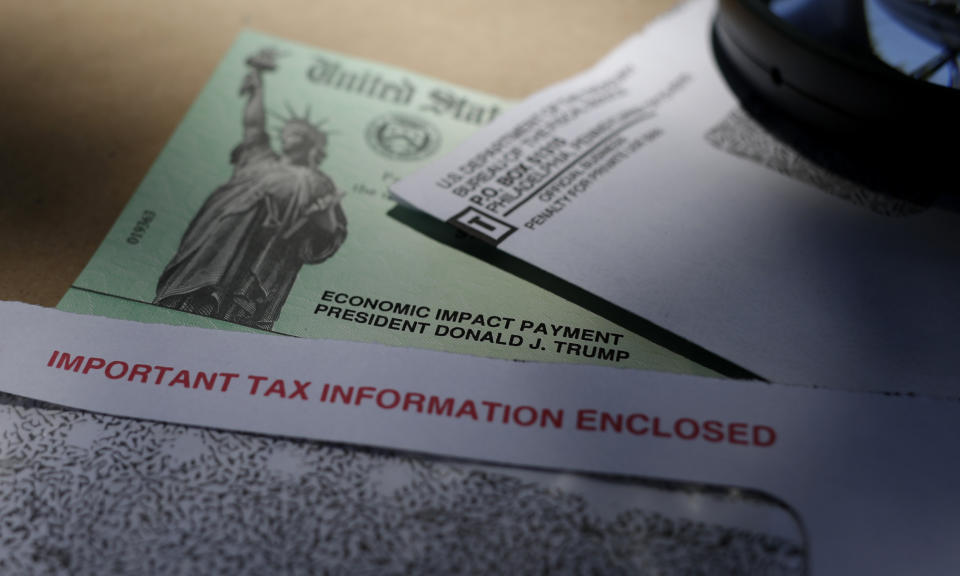

Coronavirus stimulus checks: Scammers are trying to swipe payments

Laid off and struggling financially, Angelica Ahumada badly needed the $1,200 stimulus payment from the government.

But when she logged onto the Internal Revenue Service website to add her direct deposit information to get the money faster, she was rejected.

“The system alerted me that someone had already put in banking info for me and my check was already deposited there,” Ahumada, 24, said. “I was shocked. I started crying. I really need the financial help.”

Read more: Coronavirus stimulus check scams: How to avoid becoming a victim

A victim of identity theft, Ahumada contacted the IRS, which said she needed to file her taxes this year and wait for the agency to investigate the matter before she could get a replacement check. The delay is a huge hit to her finances.

“I really need the income since I was fired due to this pandemic,” said Ahumada who lives in Kansas City, Mo. “I was going to use the check to help pay for bills and food.”

‘Pandemic is a once-in-a-lifetime opportunity’

About 175 million Americans are eligible for stimulus payments up to $1,200 — plus $500 for children under 17.

Experts warn that the distribution of stimulus payments will also create a new wave of scams, on top of the more than 18,235 coronavirus scam complaints that have been filed with the Federal Trade Commission since the outbreak.

Those most vulnerable are those who haven’t filed their taxes or don’t have direct deposit information on file with the IRS.

“For most Americans, the COVID-19 pandemic is a once-in-a-lifetime challenge,” said Shaun Barry, global leader of fraud and integrity at SAS, a developer of analytics software. “For fraudsters, the pandemic is a once-in-a-lifetime opportunity.”

Read more: Coronavirus stimulus checks: Here’s why you can’t find out your payment status

Many fraudsters will use stolen identity credentials such as your name, Social Security number, and address to file an income tax return on your behalf. The criminal will put down their bank account information, so any tax refund and stimulus check are deposited in their account.

Unscrupulous people could also exploit the new online tool the IRS released that allows non-filers to add banking information for a direct deposit— like in Ahumada’s case, Barry said.

Additionally, over 550 new websites impersonating the IRS have popped up recently, according to the cybersecurity firm Mimecast.

‘Unemployment has been a disaster’

In mid-March, Ahumada was preparing to transition to working from home at her call center job due to the coronavirus pandemic. The day she moved her equipment, she was notified she was laid off.

Since then, she’s been living off her savings. On top of her stolen stimulus payment, she’s had no luck getting unemployment insurance, another government benefit that is vulnerable identity theft scams, especially as millions of people are trying to file their claims, experts warn.

“My unemployment has been a disaster trying to get it started,” Ahumada said. “The lines are clogged and when you do get through they can’t give you the help you need.”

Read more: Coronavirus stimulus checks: Why many college students won’t get one

In the meantime, Ahumada is still waiting for a call from the IRS about her stimulus check. But getting a replacement check may take some time.

“The Treasury has to do an investigation into that particular instance,” said Thomas Edwards, special agent in charge of the San Francisco regional office for the U.S. Secret Service. “It may be awhile for you to get a replacement check if it's stolen or somebody collects on it.”

How to protect yourself from those scams

If you realize you’re a victim of a stimulus check scam, reach out to your local law enforcement either by contacting the police or your local FBI office, which normally has an outreach number.

File your taxes: To get ahead of scammers, file your taxes first before criminals have a chance. “Clever fraudsters will target those people who haven’t yet filed,” Barry said.

Don’t give out personal data: Identity thieves will try email, call, or text you with messages linking to a phony government website, according to Mike Pappacena, co-head of cybersecurity and risk at ACA Compliance, a technology consulting practice.

But the IRS only contacts taxpayers in two ways: By letter or in person. If the IRS calls you, it will only be after the agency contacted you first by mail.

Read more: Coronavirus stimulus checks: What it means for your taxes

Check the original source: You could receive fake emails asking you to reset or confirm your bank account information. If you receive one, don't click on the links or the attachment in the body. Instead, type in the bank’s address in the browser yourself.

“You need to go back to the original source,” Edwards said. “Do not pay attention to that email. Contact the bank or the credit card company directly.”

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

'Replaceable': Household help are left unpaid during coronavirus pandemic

'Struggling so severely': Coronavirus exposes the gulf between the haves and have-nots

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money