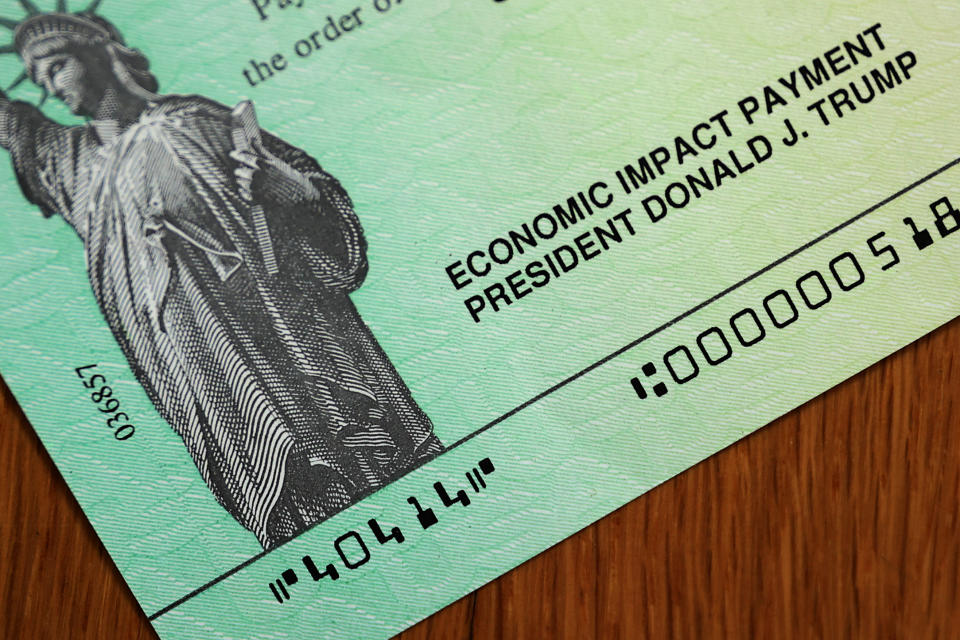

Coronavirus stimulus checks: IRS can't keep $100 million in payments from incarcerated Americans, judge rules

Incarcerated Americans — who were initially deemed ineligible for coronavirus stimulus checks — will now be able to collect them after a ruling from the U.S. District Court Northern District of California.

As a result of the ruling, at least 84,000 stimulus payments to incarcerated individuals — worth around $100 million — will not have to be returned as previously stated in guidance from the Internal Revenue Service (IRS).

“Incarcerated persons who otherwise qualify for an advance refund are not excluded as an ‘eligible individual,’” Judge Phyllis Hamilton wrote in the ruling. “The IRS’s decision to exclude incarcerated persons from advance refund payments is likely contrary to law.”

Under the CARES Act, around 160 million Americans received a stimulus payment of up to $1,200, plus $500 per dependent. The initial legislation — which passed in March — didn’t specify whether people in jail or prison would be ineligible for the payments but guidance issued by the IRS in May said that “a payment made to someone who is incarcerated should be returned to the IRS.”

“The country is suffering during this pandemic and economic crisis, and incarcerated people and the families they rely on for support are no exception,” said Yaman Salahi, a partner at Lieff, Cabraser, Heimann & Bernstein, representing the Plaintiffs and Class. “Judge Hamilton’s order ensures that incarcerated people will receive the sorely needed economic assistance that Congress allocated.”

Read more: Coronavirus stimulus checks: What’s stopping a second round of payments?

The IRS is said to have worked with federal and state prisons to return the stimulus payments made to incarcerated individuals, according to a report by a government watchdog. It’s unclear how many people in total will qualify for the stimulus checks after the ruling but the lawsuit alleges that 1.4 million have been affected by the IRS’s guidance.

If you don’t file taxes and you haven’t received a stimulus check, you can submit your information through the IRS Non-Filers Tool. The deadline for this was extended by the IRS to November 21. Americans with income below $12,200 and who haven’t filed a tax return for 2018 and 2019 can use the tool to add basic personal information in order to receive the payment.

You can check the status of your payment by using the Get My Payment tool on the IRS website.

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money