Coronavirus stimulus checks: 128 million Americans have received over $200 billion so far

Around 128 million Americans have received their stimulus check payments, according to new data from the Internal Revenue Service, with the average amount totaling $1,700. So far, $216 billion in payments have been issued.

"We are working hard to continue delivering these payments to Americans who need them," said IRS Commissioner Chuck Rettig in a statement. "The vast majority of payments have been delivered in record time, and millions more are on the way every week."

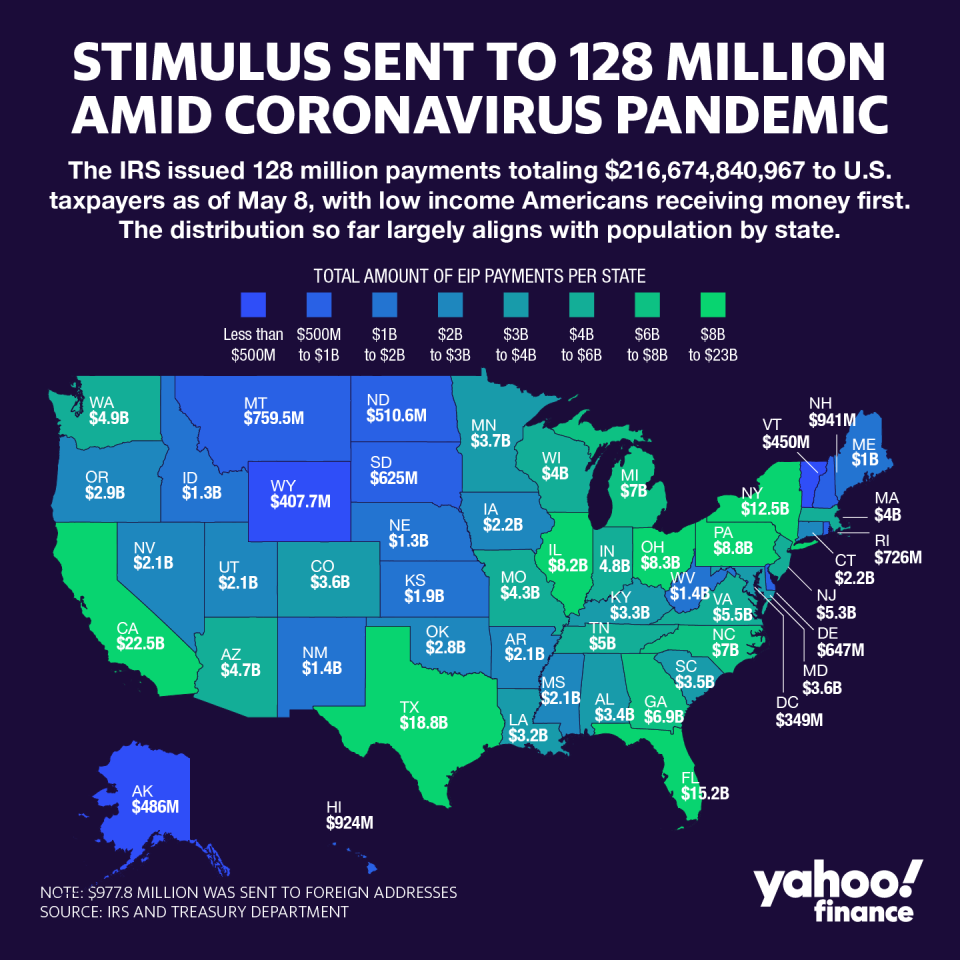

California, Texas, and Florida — the three most populous states — have received the most individual payments and the largest total amount in stimulus worth $22.5 billion, $18.8 billion, and $15.2 billion, respectively.

Those who are eligible for a payment, but have no direct deposit information on file a the IRS have until noon on Wednesday, May 13 to provide the information online to get their payment quicker. If they don’t meet the deadline, they will get a paper check mailed to them instead, according a statement by the IRS.

“Time is running out for a chance to get these payments several weeks earlier through direct deposit,” Rettig said.

As part of the $2 trillion stimulus package, a total of $250 billion is being distributed to Americans’ wallets to help them financially ride out job loss, reduced work hours, and other money hardships they’re facing. About 175 million Americans are eligible for the payments, according to the White House.

Read more: Coronavirus stimulus checks: Here's why you can't find out your payment status

The majority of payments have been distributed for taxpayers with direct deposit information on file, while paper checks continue to be issued through late May and into June. Social Security recipients have also started to receive their payments either by direct deposit or by check, depending on the way they typically receive their benefits, a Treasury spokeswoman told Yahoo Money on Monday.

Americans can track the status of their stimulus payments and add direct deposit information on the IRS website if those details aren’t on file with the agency. Those who don’t usually file taxes can also provide the IRS with their information to get their stimulus payment.

Here’s everything you need to know about the stimulus check.

Who gets a stimulus check?

As part of a $2 trillion coronavirus relief package, many Americans will get government checks up to $1,200 — plus $500 per child — to help them ride out a job loss, reduced work hours, and other money challenges as the country tries to stem the pandemic.

“Our updated estimate is that 93.6% of [tax] filers will have a rebate,” Garrett Watson, senior policy analyst at The Tax Foundation, said. “And this works out to approximately 140 million households.”

Your eligibility is based on your most recent tax return and your adjusted gross income. If you already filed your 2019 taxes, your eligibility will be based on that. If not, the IRS will use your 2018 taxes to determine if you qualify.

The benefit is available not only to those who have filed taxes, but also to those who receive Social Security benefits as long as they’ve received their SSA-1099 or RB-1099 forms.

Read more: Tax deadline postponed: Why you should still file as soon as you can

Single adults with income up to $75,000 will get a $1,200 payment. Married couples with income up to $150,000 will get $2,400. Single parents who file as head of household with income up to $112,500 will get the full $1,200 check.

And, Americans who qualify for the stimulus payment and have children will get an additional $500 per child under 17.

Reduced checks will be available for single adults who earn between $75,001 and $99,000 and married couples who earn between $150,001 and $198,000.

The check will be reduced by $5 for every $100 over $75,000 for single adults and $150,000 for married couples. The reduction will apply to the entire amount of the payment including the additional $500 per qualifying child.

Who doesn't get a check?

Single adults who make more than $99,000 and married couples who earn more than $198,000 won’t receive stimulus checks.

Read more: Coronavirus stimulus checks: Why many college students won’t get one

Those without a Social Security number and nonresident aliens — those who aren’t a U.S. citizen or U.S. national and don’t have a green card or have not passed the substantial presence test — aren’t eligible.

You’re also ineligible if your parents claim you as a dependent on their taxes.

How will the government send you the stimulus check?

The IRS will use the direct deposit information you provided from the taxes you’ve filed either for 2019 or for 2018.

The payments will be deposited directly into your bank account if you received your last tax refund or expect to receive this year’s refund that way.

Otherwise, checks will be mailed, which could take longer to get to Americans. Adding to the complications, about 6% of U.S. adults — or about 12 million Americans — do not have a checking, savings, or other bank account, according to a 2018 Federal Reserve report.

Read more: Coronavirus stimulus check scams: How to avoid becoming a victim

Social Security and Veteran Affairs recipients will get their payments deposited automatically but benefit recipients with qualifying dependents and they haven’t filed taxes for 2018 or 2019 will have to use the ‘Non-Filers’ tool to file a simplified return to get the additional $500 per child.

How can those who don’t file taxes get a payment?

Americans who don’t usually file taxes can register to get their stimulus aid checks on IRS website or use Turbotax’s free tool to file a minimum tax return.

The IRS tool is for eligible U.S. citizens or permanent residents who had gross income below $12,200 ($24,400 for married couples) for 2019 and weren’t required to file a 2019 federal tax return.

“There are as many as 10 million Americans who are not required to file a tax return,” TurboTax said in a statement. “Because the IRS will use the federal tax return to determine and send individual stimulus payments, these individuals are at risk of not receiving their stimulus payment.”

Read more: Coronavirus stimulus checks: How to get one if you don’t file your taxes

The tools will use the information to file and automatically complete a Form 1040 and send it to the IRS.

They’ll also help determine if you’re eligible for the stimulus payment. If eligible, you need to answer a few questions, provide the required information, and choose whether to get the payment through direct deposit or check. If you don’t provide direct deposit information, the check will be mailed to you.

Social Security recipients and those required to file tax returns don’t need to provide additional information, but still must meet the eligibility criteria to get a payment.

When are you getting the payment?

This week, the IRS starts sending paper checks on a weekly basis to individuals whose direct deposit information isn’t on file.

Paper checks will be issued at a rate of about 5 million per week. The latest projection is that the paper check will be delivered through late May and into June, according to a statement by the IRS.

The checks will be issued in reverse “adjusted gross income” order — starting with people with the lowest incomes first. Taxpayers with income up to $10,000 will be the first to get their checks, which were expected to arrive by April 24.

Americans with income up to $20,000 are expected to get their checks by May 1, while those with income up to $40,000 by May 15. The rest of the checks will be issued by gradually increasing income increments each week. Households earning $198,000 who file jointly will get their reduced checks on Sept. 4. The last group of checks will be sent on Sept. 11 to those who didn’t have tax information on file and had to apply for checks.

Social Security and other benefits recipients who haven’t filed taxes in the last two years will receive their automatic payment at the end of April.

Can you track the payment?

Yes. Those who are still waiting can track it online. Americans are also able to provide the Internal Revenue Service with their direct deposit information if it’s not on file with the agency.

“If you do not receive them by Wednesday, you’ll be able to put in your direct deposit information, and within several days, we will automatically deposit the money into your account,” Treasury Secretary Steven Mnuchin said on Monday. “We want to do as much of this electronically as we can.”

The new tool allows Americans to follow the scheduled payment date for either a direct deposit or mailed check. It’s an online app that works on desktops, phones, or tablets and doesn’t need to be downloaded from an app store, The Treasury said.

To track your payment, you must provide basic information including:

Social Security number

Date of birth

Mailing address

The tool also lets people provide their bank account details to get their payment by direct deposit instead of waiting for a mailed check, which go out April 24.

If you filed a tax return in 2018 or 2019 but didn’t provide direct deposit information, you’ll be able to identify yourself, input that banking information, and receive the payment in several days in your account, according to Mnuchin.

To add direct deposit information, you will need to provide:

Adjusted gross income from your most recent tax return submitted, either 2019 or 2018

The refund or amount owed from your latest filed tax return

Bank account type, account, and routing numbers

Do you have to pay tax on it?

No. The stimulus payments are federal income tax refunds and aren’t subject to federal income tax.

Do you have to pay back the stimulus check?

No. The stimulus payment is actually a refundable credit against your 2020 tax liability, according to Kyle Pomerleau of the American Enterprise, and is paid out as an advanced refund. That means you don’t have to wait to file your 2020 taxes to get the money.

It also doesn’t reduce any refund you would otherwise receive, Watson said.

In fact, if you don’t qualify for the stimulus check now based on your 2018 or 2019 tax returns, you may be able to qualify to take the tax credit next year when you file your 2020 taxes if your income meets the thresholds.

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Lenders slash credit limits, tighten standards as Americans lose jobs in the pandemic

Coronavirus stimulus checks: Americans vent frustrations about problems receiving the money

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money