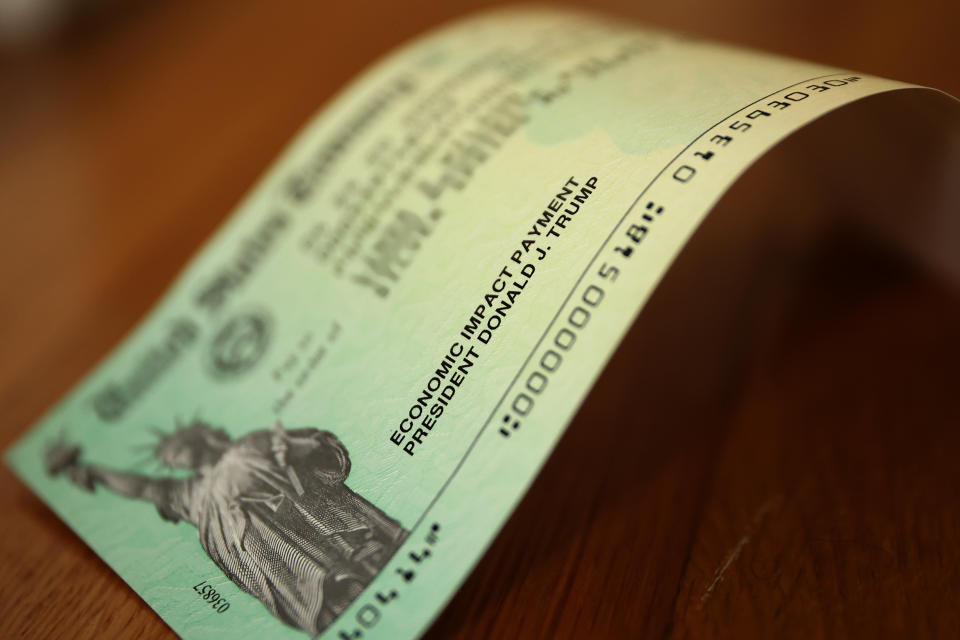

Coronavirus stimulus checks: 12 million Americans risk missing out by not filing form

The majority of stimulus checks have now been distributed with over 159 million Americans receiving payments, according to the latest data from the Treasury Department. Still, there are more to be sent, but some eligible Americans — especially blacks and Latinos — are at risk of not getting theirs.

Around 12 million Americans could miss out on stimulus payments unless they file a form through the Internal Revenue Service’s ‘Non-Filers’ tool by Oct. 15, according to a new report from the Center on Budget and Policy Priorities. This includes low-income families with children, people disconnected from work opportunities, and low-income adults not raising children in their home.

Governors and other state officials could play an important role in reaching those 12 million people, because 9 million of them are enrolled in the Supplemental Nutrition Assistance Program (SNAP) or Medicaid, which states and counties administer and help eligible individuals to apply.

“This group of non-filers eligible for payments are disproportionately people of color because they are likelier to have lower incomes due to historical racism and ongoing bias and discrimination,” the authors of the report wrote. “Ensuring that low-income people of color receive the payments for which they qualify is especially important given emerging evidence that they are being hit hardest by both the economic and health effects of the pandemic.”

Read more: Coronavirus stimulus checks: Here's how people are spending their relief money

Approximately 1 in 4 of those 9 million people are black, while 2 in 5 are Latino. The automatic payment method missed them because they were not required to file a tax return, the report found.

Who else is at high risk of not receiving a payment?

Of the 9 million people that state agencies could contact, 2 in 5 are adults not raising their children in their homes, and 1 in 5 are people with lower education levels. These are groups who are also financially vulnerable and these payments could provide effective stimulus for them and the economy.

“The payments for the 12 million people at risk of missing out on them would be particularly effective in boosting economic activity because these individuals have very low incomes and tend to live close to the edge, spending (rather than saving) any additional money they receive,” the authors of the report wrote.

Read more: Coronavirus stimulus checks: Why your payment would be smaller than expected

The 12 million at risk of not receiving their stimulus are predominantly non-elderly with incomes up to $12,400 for singles and $24,800 for married couples.

Many senior citizens received theirs directly because of the payments they get through Social Security, Railroad Retirement, SSI, or veterans’ pensions. But 1 million seniors may be eligible for payment they didn’t receive automatically, according to the report.

How to use the IRS tool?

Americans who don’t usually file taxes can register to get their stimulus aid checks on the IRS website, which requires you to file a minimum tax return.

Read more: Coronavirus stimulus check: How to get one if you don't file your taxes

The IRS ‘Non-Filers’ tool is for eligible U.S. citizens or permanent residents who had gross income below $12,200 ($24,400 for married couples) for 2019 and weren’t required to file a 2019 federal tax return.

You will need to provide the following information:

Full name, mailing, and email address

Date of birth and Social Security number

Bank account number, type, routing number (if you have one)

Identity Protection Personal Identification Number (if you have one)

Driver’s license or state-issued ID (if you have one)

Information about qualifying children: Name, Social Security number or Adoption Taxpayer Identification Number, and their relationship to you or your spouse

The tools will use the information to automatically complete and file a Form 1040 with the IRS.

The tool will also help determine if you’re eligible for the stimulus payment. If eligible, you need to answer a few questions, provide the required information, and choose whether to get the payment through direct deposit or check. If you don’t provide direct deposit information, a check or a pre-paid debit card will be mailed to you.

Social Security recipients and those required to file tax returns don’t need to provide additional information but still must meet the eligibility criteria to get a payment.

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Here's why the US still has one of the highest jobless rates among developed countries

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money