Coronavirus: How the law can protect you if you can't pay your rent or mortgage

Individuals and businesses finding they can’t make rent or mortgage payments as coronavirus lockdowns continue to cut into the economy, must rely, for now, on a patchwork of federal and local legal protections that may help them hold onto their property.

“Unfortunately, we were not prepared as an industry to deal with something like this,” Peter Oxman, a partner with Seyfarth Shaw’s real estate practice, told Yahoo Finance, “and we did not have a plan that could quickly be activated.”

The lack of preparation has left some tenants at the mercy of landlords and local governments, like New York state, which has issued a moratorium on residential and commercial evictions for those who can’t pay rent. Others may receive protections like payment deferrals under the new coronavirus stimulus package. Still, other homeowners and owners of commercial properties are left to plead with their mortgage lenders for relief.

Oxman said, despite that lack of preparation, he’s encouraged to see landlords, tenants, lenders and borrowers coming up with creative solutions to avoid a domino effect that could wreak havoc for all parties involved if landlords and lenders pursue evictions and repossessions, and if tenants and borrowers walk away from their leaseholds and purchases.

Forbearance through Fannie Mae and Freddie Mac

Multiple forms of relief are already mandated by law. Under the CARES Act, federal legislation that went into effect on March 27, owners of single family and multifamily dwellings financed through Fannie Mae, Freddie Mac, or the Federal Housing Administration (FHA), are entitled to forbearance options if their ability to make mortgage payments is impacted by the novel coronavirus. Renters who lease within a multiunit property financed through the government-backed entities also get relief.

For renters in qualifying buildings, landlords are prohibited from filing payment-based eviction proceedings through July 25. In addition, landlords may not charge fees, penalties or other charges related to unpaid rent.

Single family homeowners with property financed through Fannie Mae or Freddie Mac get similar relief. Foreclosures and evictions on such properties are suspended at least until May 17, and forbearance may be granted for up to a year.

Borrowers who financed multifamily properties (those with more than 5 units) through the agencies are eligible for forbearance up to 90 days. And while tenants of such properties are already protected from eviction until July 25, borrowers who elect to use the forbearance may not to evict any tenant based on failure to pay rent.

Still, none of the CARES Act relief spares property owners or tenants from their legal obligation to make payments on residential or commercial properties that are not backed by the government entities. Absent workarounds with their lenders, or an order from a local government, they remain on the hook.

In efforts to urge lenders to offer more alternatives to mortgage borrowers, additional guidance was issued Tuesday by five federal agencies including the Board of Governors of the Federal Reserve, the Consumer Financial Protection Bureau, and the Federal Deposit Insurance Corporation. The guidance clarified loan modification rules for lenders operating under the CARES Act. According to the guidance, loans modified due to impacts of coronavirus are exempt from classification as troubled debt restructurings or TDRs.

The exemption should encourage lenders to offer modifications because it will temporarily suspend certain TDR accounting requirements that can negatively impact a lender’s balance sheet. The exemption applies as long modifications are related to COVID-19, are for loans not more than 30 days past due as of December 31, 2019, and are executed between March 1, 2020, and December 31, 2020, or 60 days after the National Emergency order is terminated, whichever comes first.

In an interview following an announcement on Thursday that the Federal Reserve plans to provide up to $2.3 trillion in loans to support households and local governments, Chairman Jerome Powell told Brookings’ David Wessel, “We are watching carefully the situation with the mortgage servicers, and I will just tell you that we certainly have our eyes on that as key market that does support households and consumer spending really which is of course 70% of the economy.”

Currently, 27,000 U.S. apartment buildings are financed through Fannie Mae and Freddie Mac. In total, the properties house 4.2 million renters.

Shravan Parsi, CEO and founder of American Ventures, a commercial real estate company that owns and operates 700 residential units in Texas, is among those multiunit owners trying to navigate the best way to keep his company afloat.

“Unless we collect the rent we cannot pay the loan,” Parsi told Yahoo Finance.

So far, he said he has not decided whether to take advantage of the FHA’s forbearance program, though he is eligible and has decided to apply for the law’s Payroll Protection Program to ensure he can pay his staff. For his tenants, who on average earn between $40,000 and $100,000 per year, Parsi has adhered to the FHA’s mandate and done away with late fees and promised no eviction proceedings for 90 days.

‘They’re simply shutting down courts’

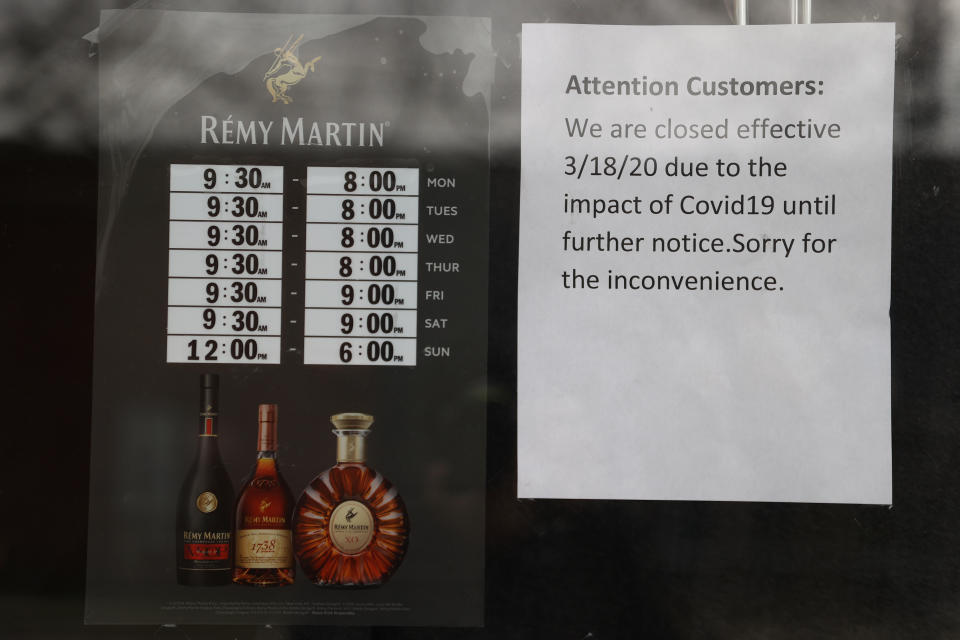

Some renters are finding relief through local governments that have adopted measures to prohibit payment-based evictions. States and municipalities are stepping in to ensure that those who do not qualify under federal anti-eviction protections are not put out on the street.

New York State implemented a 90-day moratorium on evictions for residential and commercial tenants, while New York City lawmakers have proposed legislation to extend a city-wide moratorium to 6 months after the state of emergency ends. Los Angeles, San Francisco, and San Jose, among other cities, put into place temporary no eviction orders, and Miami-Dade’s police force announced it would refrain from carrying out eviction orders.

Some cities and states such as Philadelphia, Chicago, and Massachusetts have accomplished similar objectives through their court systems.

“They’re simply shutting down the courts and saying they're not going to hear those cases right now,” Oxman said. “So as a practical matter, if the courts are shutting down that tends to limit the ability of a landlord to force an eviction.”

Cities are also the decision makers when it comes to public housing tenants, as the Department of Housing and Urban Development (HUD) lacks legal authority to force local arms to forgo evictions. New York, Los Angeles, and Boston, in addition to other cities, have instituted non-eviction measures for public housing tenants.

Renters impacted by COVID-19 should check with their local authorities to inquire whether a local order is in place that allows them to defer payments and remain protected from eviction.

‘We’re not going to be paying rent until this is over’

For commercial properties, Oxman said leaseholders and landlords are experimenting with their own forms of forbearance. Some of his clients are offering 3-month abatements on payments with a 3-month extension of the least term. Others are delaying payments that will be added to the total due under the lease and divided over the remaining payments once the national state of emergency is lifted. Still other clients are working to get out of their lease obligations altogether.

“Some tenants are just sending letters to their landlords saying we've closed our stores and we are not going to be paying rent until this is over,” Oxman said. “Some of them are saying, due to force majeure we're not going to pay rent.”

Attempts at invoking force majeure, he explained, will mostly fail if used to avoid rent payments, as commercial leases typically include exception so that such clauses do not apply. On the other hand, the clauses do tend to permit tenants to suspend other actions such as deadlines to move in or out of properties, he said.

While Parsi’s company collected 90% of rents for April, he’s more concerned about May and June.

“We dodged the bullet for our assets for the month of April,” he said. “What concerns me most right now is there is no end in sight. We were talking about the end of May and now it’s the end of June.”

According to a report published by the National Multifamily Housing Council, 13% fewer tenants who reside in multiunit dwellings paid rent during the first five days of April 2020, compared to the same timeframe last year. The change is making it difficult for landlords to anticipate how much they need to rely on stimulus funds.

“We don’t have a plan of action for 90 days from now, which is pretty unusual,” Parsi said. “This is uncharted territory.”

Alexis Keenan is a reporter for Yahoo Finance and former litigation attorney.

Follow Alexis Keenan on Twitter @alexiskweed.

Read more:

Coronavirus small business stimulus program off to a rocky start

Amazon sought ‘retaliation’ when it fired worker who led walkout: NY AG

Coronavirus fears spur shoppers to wait in 2-hour line for firearms

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

money

money