Over 9 million Americans lost health insurance amid coronavirus pandemic, analysis finds

The coronavirus pandemic has had a devastating impact on the U.S., wreaking both economic and health-related havoc on the American workforce.

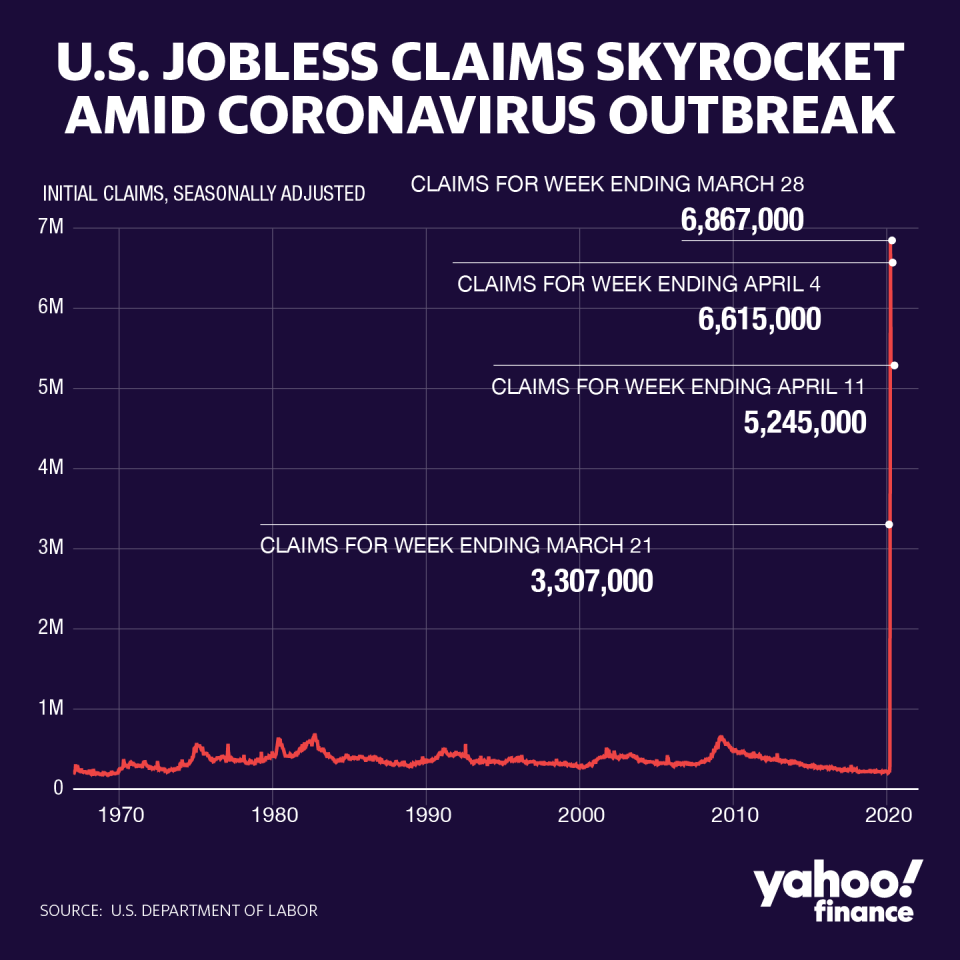

In the four weeks leading up to April 11, the number of unemployment claims topped 22 million. According to the Economic Policy Institute (EPI), that means that roughly 9.2 million workers likely lost their employer-sponsored health insurance during that time.

“As people continue to lose their jobs, which we expect that they will do unfortunately, we’re going to see losses in health insurance coverage,” Ben Zipperer, an economist at EPI, told Yahoo Finance. “That’s because in the United States, we’ve chosen as a country, unfortunately, to tie access to health insurance with employment.”

He continued: “If we avoided that, if we made sure everybody was covered, everybody has access to health insurance regardless of their employment status, we wouldn’t be in this kind of predicament.”

‘We could see continued growth of uninsured Americans’

Nearly half of all Americans receive their health insurance through their employer. And given the cost of treatment for COVID-19 (and the cost of health care in the U.S. more generally), that’s a problem.

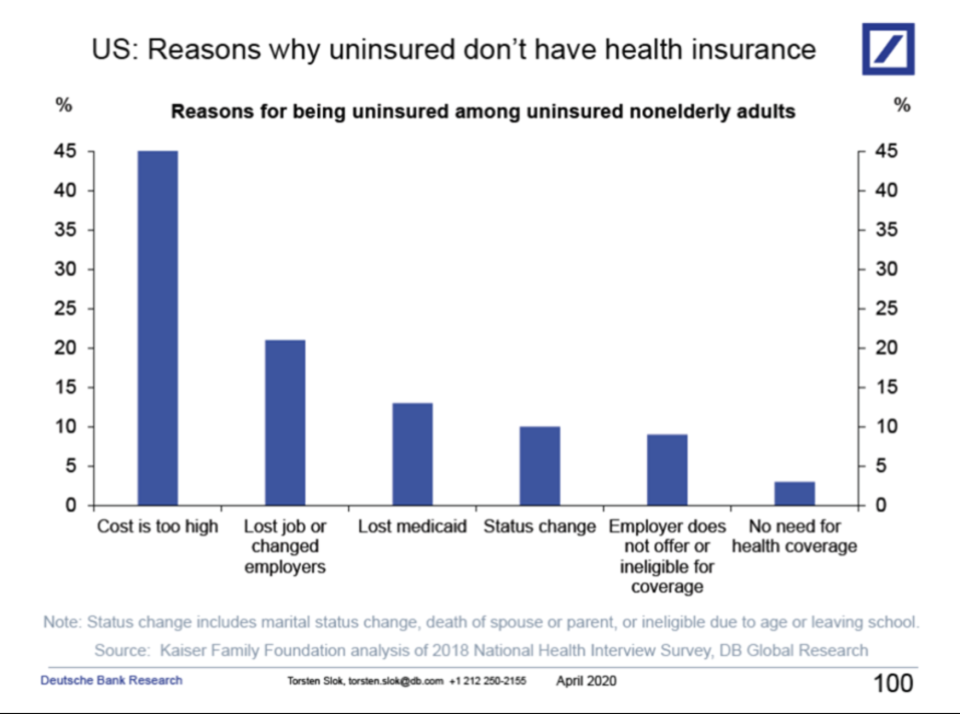

Roughly 29 million Americans were uninsured in 2019. A chart from Deutsche Bank shows the main reasons why. These include costs being too high, losing jobs or changing employers, and losing Medicaid.

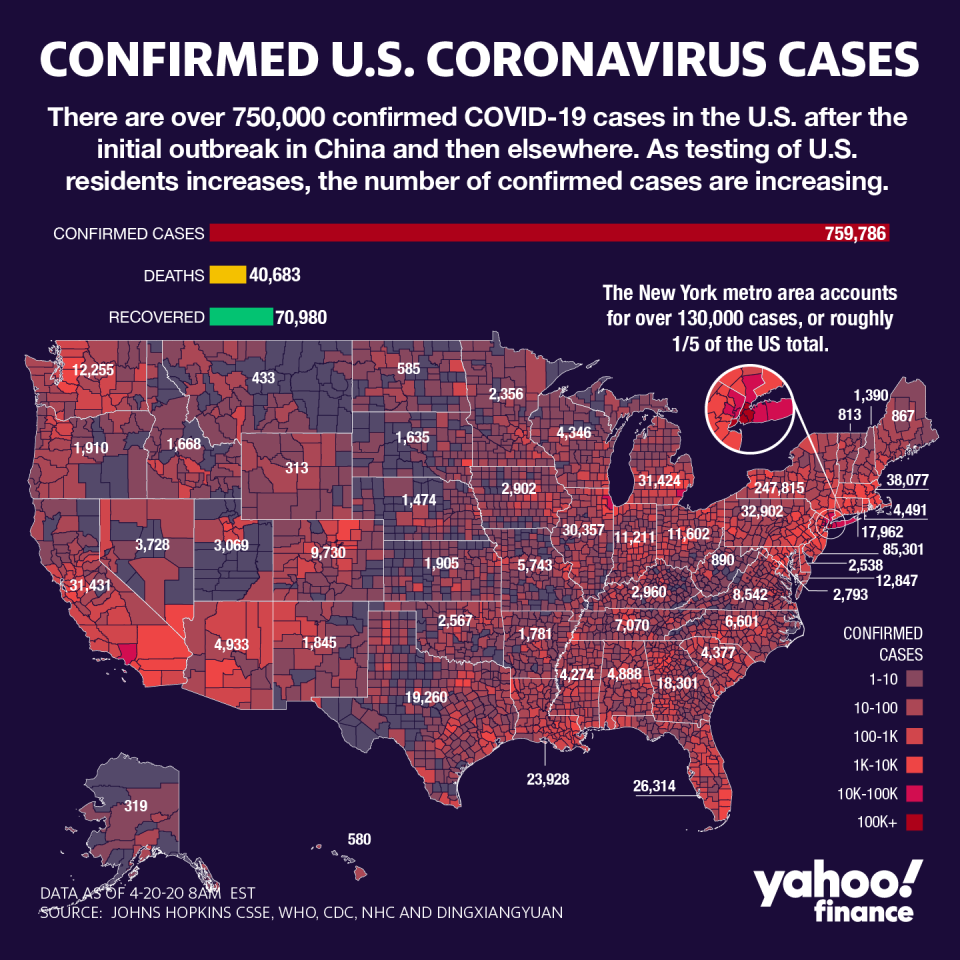

There are more than 750,000 confirmed cases of coronavirus in the U.S. and over 39,000 deaths. The number of hospitalizations brought about by the virus could lead to higher health care costs down the road.

“The danger is that if there isn’t a concerted effort to address the health care costs, we could see continued growth of uninsured Americans and small and large businesses dropping out of operating health coverage,” Peter Lee, executive director of Covered California, the state’s health care marketplace, previously told Yahoo Finance.

A recent survey by sidecar health polled individuals who lost their jobs and employer-provided health insurance due to coronavirus. It found that 55% have faced challenges finding health insurance and 43% were unlikely (somewhat or very) to seek medical care while without health coverage. The biggest challenges facing these individuals, according to the survey, were the high costs and lack of options.

What to do if you’ve lost your health care coverage

For those who have lost their job (and therefore their health insurance) because of coronavirus, they are eligible for a special enrollment period (SEP), which involves re-opening the Healthcare.gov enrollment site.

Read more: How to get ACA health insurance if you lose your job

Generally, people are only able to obtain health care coverage during open enrollment. However, getting laid off is considered a “qualifying event,” which means the person can sign up for health care coverage outside of open enrollment.

Another option is COBRA, which means the individual continues the same health care coverage they had under their employer-based health insurance, though COBRA has higher premium payments since there is no longer an employer contribution. And if income is considered low enough, a person may be eligible for Medicaid.

Read more: COBRA insurance: How to file if you lose your job

These could be expensive options, however, if there isn’t any income to supplement the cost.

“That’s why many countries — rich countries especially — have publicly subsidized their health insurance so that people pay through for public health insurance just like they do for our public education system,” Zipperer said. “So that everybody has access to health insurance at all times.”

Among the richest countries in the world, the U.S. spends the most on health care despite the jarring lack of coverage. Amidst this pandemic, support for Medicare for All stands at 55% — a 9-month high.

“There are a lot of different solutions, but they all involve covering everyone regardless of their employment status,” Zipperer said. “We already have public health insurance programs that are limited to a small segment of the population, like Medicare and Medicaid, and in principle, it would be easy to expand those to the rest of the population. One way to start is to expand those to include people who have lost their jobs.”

Adriana is a reporter and editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

Coronavirus and the U.S. health insurance system is 'a recipe for disaster'

Coronavirus hospital bills: A look at the costs for Americans

Coronavirus pandemic shows 'dysfunctionality' of US health care: Bernie Sanders

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money