Chopped down: Why has the stock of wood pellet producer Enviva fallen 85% in a year?

The stock is off 87% from its high in April 2022. It plummeted an eyewatering 67% on just one day − May 4.

But this isn't a cryptocurrency business, struggling electric vehicle manufacturer or failing tech company that has yet to turn a profit.

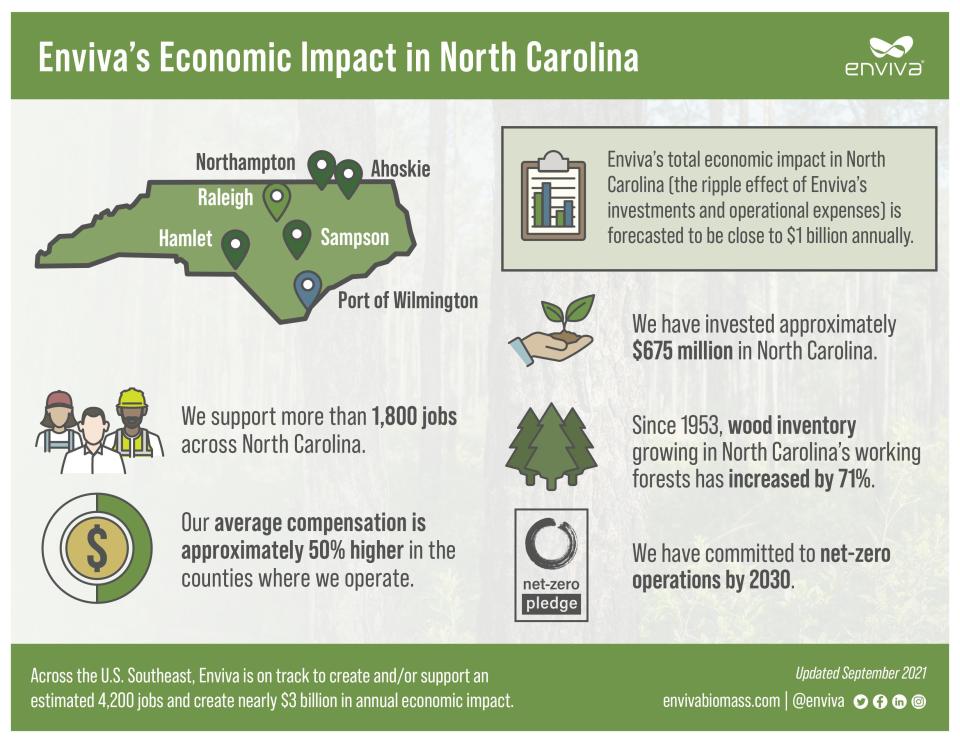

It's Maryland-based Enviva, the world's largest wood pellet manufacturer that supports more than 1,800 jobs in mostly rural North Carolina at its four wood pellet production plants and Port of Wilmington facility.

The company, which supplies European and Asian utilities with wood pellets as an alternative to burning dirty coal, has long been a target for environmentalists. They question the alleged sustainability value of chopping down trees in the U.S. South, processing them and then shipping the pellets thousands of miles to burn as a "clean" fuel source for power plants.

But the company's recent financial meltdown appears to be related to operational issues, not slumping demand for its product.

Thomas Meth, Enviva's president and CEO, on May 3 said the company is facing several challenges, including high contract labor prices and maintenance and operational woes at some of its plants.

"Because of where we are in our journey to bend our cost curve down while bending our production curve up, we feel it is prudent to take a much more conservative view of what our business can realistically achieve over the next eight months," he said as the company announced its disappointing first-quarter results.

Meth also said Enviva was now forecasting a larger-than-expected loss for the full year, up to $186 million from an earlier estimated maximum of $48 million, and was eliminating its dividend to shareholders, which should free up nearly $1 billion through 2026 to help meet operational needs and support the company's expansion plans.

'Still see much to like'

The announcement of the poor first quarter, and especially the plan to stop paying dividends, sent Enviva's stock plummeting.

"We still see much to like in the business − long-term contract visibility, ample demandgrowth in both Europe and Asia, and a play on energy security − but today is also a reminder thatthere is no substitute for quality operational execution," stated a research note from Raymond James a day after Enviva announced its poor first-quarter financials. "The pivot from reaffirming the existingdividend at the analyst meeting one month ago to halting it today is very jarring."

The Bambi effect: Are deer a bigger threat to NC forests than climate change?

As of the end of May, Raymond James still had a "strong buy" recommendation on the company's stock. But the financial firm in a May 26 note warned that Enviva has to move fast to build back confidence with investors and aggressively move to bring its cost structure under control.

Citigroup also had a "buy" investment rating on Enviva, while Truist Securities had downgraded its rating from "buy" to "sell" after the company's first-quarter performance.

Rural economic powerhouse

Enviva has invested significant sums in Eastern North Carolina to take advantage of the region's extensive forests. According to Enviva, the company supports more than 1,800 jobs across North Carolina and has invested more than $675 million in the state. Facilities are also located in six other Southeastern U.S. states, with several more plants planned.

The impetus for the company's growth was a decision by the European Union more than a decade ago to financially incentivize its member states to shift from using polluting fossil fuels like coal as a power source to renewable energy, such as solar and wind. Also included on that list was biomass, which suddenly made wood a product in high demand. That made the U.S. South's more than 50 million acres of forests a hot commodity.

Enviva's growth and demand for wood products has been a shot in the arm for struggling rural communities and timber landowners, with North Carolina providing incentives to support job creation in some areas.

Growing headwinds?

But even as demand continues to remain strong, Enviva's plans to grow rapidly − potentially doubling production to 13 million metric tons later this decade − to meet existing and future contracts for its pellets could be brought into question by the company's financial woes.

Emily Zucchino, director of community engagement for the Asheville-based Dogwood Alliance, which works to protect Southern forests and end industrial logging, said Enviva's problems are piling up.

"It looks like they've gone into this growth model a little too quickly and that they might have trouble managing the business plan that they've sold to investors," she said.

Zucchino added that the company also is facing other headwinds, including a shareholder suit over the viability of its environmental and financial credentials and environmental justice concerns over placing its plants in predominantly poor and minority rural communities.

"Investors will take notice, and they don't like risk and negative attention," she said.

Challenging times

While admitting the company is facing challenges, Enviva officials remain bullish on the company's future.

Showcasing the strong market for its product, the company recently signed a contract with a Japanese customer for 300,000 metric tons of pellets a year once new plants come online.

Enviva also has plans to provide "green" crude producers with wood biomass here in the U.S, − its first domestic customers − to help produce sustainable aviation fuel. President Biden's Inflation Reduction Act (IRA) includes significant tax credits and other incentives to help support the adoption of "green" fuel by the aviation industry.

WOOD POWER Could wood from NC forests soon be fueling your next airline flight?

But it remains to be seen if the company can bring new plants online while controlling costs and keeping existing plants operational.

"Although the future continues to be incredibly bright for Enviva’s business, we have had a difficult and disappointing start to 2023," Enviva's Meth said. "Operating cost overages and production challenges were key drivers behind the first quarter's poor performance."

As of Friday's stock market close the company's stock was trading at just under $11 a share. It reached more than $87 a share in April 2022.

An Enviva spokesman this week said he couldn't offer any more insight into the company's financials than what was included in the May release and call with investors.

Reporter Gareth McGrath can be reached at GMcGrath@Gannett.com or @GarethMcGrathSN on Twitter. This story was produced with financial support from 1Earth Fund and the Prentice Foundation. The USA TODAY Network maintains full editorial control of the work.

This article originally appeared on Wilmington StarNews: Enviva stock plummets as financial woes mount for wood pellet producer

money

money