Bitcoin news – live: BTC price closes in on all-time high as meme coin suddenly surges 1,000%

Bitcoin returned above $50,000 this week for the first time since early September, following a market-wide resurgence.

The cryptocurrency reached above $55,000 on Wednesday, with the latest price gains coming after bitcoin briefly fell below $30,000 at the end of July. Bitcoin is now less than $10,000 away from the all-time price high it experienced in mid April.

Other leading cryptocurrencies have mirrored bitcoin’s fortunes in recent weeks, with Ethereum (ether), Binance Coin and dogecoin all rising by between 15-30 per cent since this time last week.

The overall crypto market is now valued at nearly $2.2 trillion – up more than 15 per cent since the start of October.

After a poor September, some analysts are predicting a strong end to 2021. One price prediction model, which proved remarkably accurate in August and September, puts bitcoin on track to hit six figures before Christmas, though there are some caveats.

We’ll have all the latest news, analysis and expert price predictions right here.

Read More

Key points

Bitcoin blasts past Facebook

Bitcoin price recovery divides analysts

Baby Shiba Inu coin moons 1,000% in price

14:57 , Anthony Cuthbertson

While the majority of the crypto market settles after a bubbly few days, one meme coin has bucked all trends to shoot up 1,000 per cent over the last 24 hours.

Baby Shiba Inu has risen from $0.0000000026 to above $0.000000029, ranking it among the top 3,000 cryptocurrencies on CoinMarketCap’s index.

While the gains are only of a fraction of a per cent of a US cent for the dogecoin-inspired cryptocurrency, it is still a remarkable rise for what is essentially a joke of a joke. One reason for the sudden burst could be Elon Musk’s new Shiba Inu puppy, which he has been tweeting about this week.

George Soros fund reveals it owns bitcoin

12:34 , Anthony Cuthbertson

The hedge fund of billionaire investor George Soros has revealed that it owns bitcoin.

The revelation comes amid a major uptick in cryptocurrency from institutional investors in 2021, which has helped push bitcoin’s price up and solidify support to prevent it falling too far when its value drops.

“We own some coins - not a lot. The coins themselves are less interesting than the use cases of DeFi and things like that,” said Soros Fund Management CEO Dawn Fitzpatrick.

“I’m not sure bitcoin is only viewed as an inflation hedge here. I think it’s crossed the chasm to mainstream.”

Salvadorans stock up on bitcoin

07:41 , Anthony Cuthbertson

The president of El Salvador has revealed that people in the Central American country are now buying more bitcoin than they are withdrawing.

It’s been roughly one month since El Salvador became the first country in the world to adopt bitcoin as legal tender, and the $30 of cryptocurrency each citizen was given through the Chivo wallet app at the time is now up around 10 per cent.

President Nayib Bukele has faced criticism from political opposition for the bold move, though the recent price surge appears to have quietened critics thanks to the wealth it has at least temporarily generated for Salvadorans.

Since yesterday, Salvadorans are inserting more cash (to buy #bitcoin) than what they are withdrawing from the @chivowallet ATMs.

And if we add remittances (almost $2 million per day), the incoming USD QUADRUPLES the outflow.

This is very surprising so early in the game.— Nayib Bukele 🇸🇻 (@nayibbukele) October 7, 2021

Bitcoin consolidates price gains

07:30 , Anthony Cuthbertson

The price of bitcoin has steadied at just under $55,000 on Thursday morning, consolidating the massive gains made on Tuesday and Wednesday.

The cryptocurrency is now less than $10,000 away from it’s all-time high, and if it sees the same gains over the next seven days as it did during the last week, then it will smash past its record.

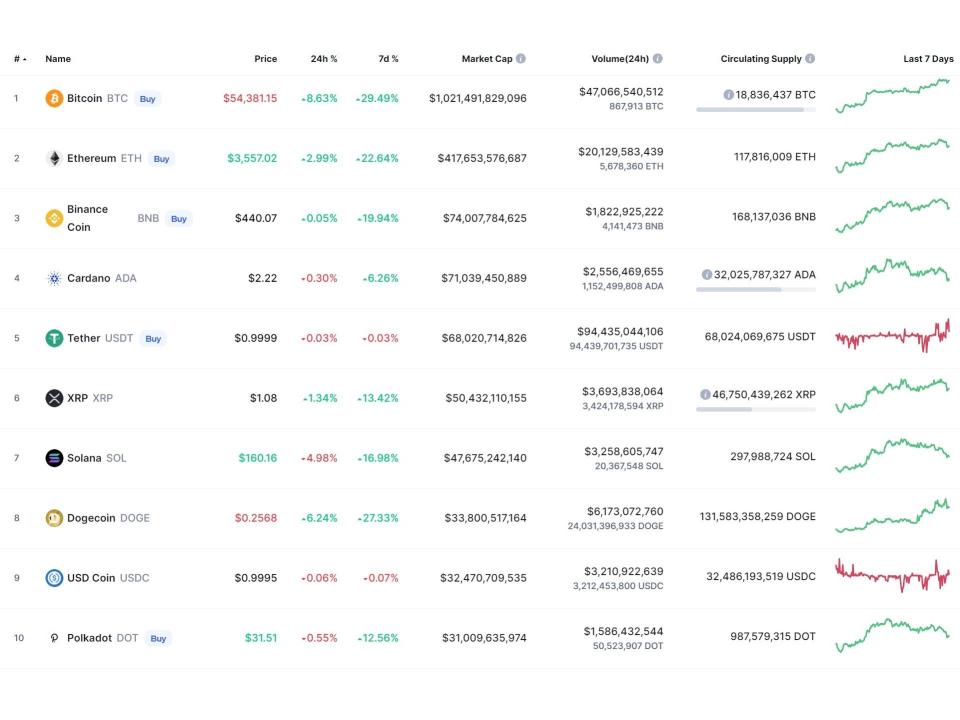

Not all leading cryptocurrencies have seen gains over the last 24 hours, with Cardano (ada), Solana (SOL) and dogecoin all seeing slight dips in value.

Here’s a snapshot of the market this morning, courtesy of CoinMarketCap.

What caused today’s bitcoin price surge - and what comes next?

Wednesday 6 October 2021 18:37 , Anthony Cuthbertson

Bitcoin’s notoriously volatile price movements mean it can be difficult to pin any single rise or drop to a single event. There are usually multiple factors at play, which can then snowball into other forces that either push it even further on its trajectory or cause it to rebound in the opposite direction.

We’ve heard from several market experts and crypto analysts, all trying to make sense of the latest price rally. Reasons range from Facebook’s mass outage, to the impact of the pandemic. They also offer their thoughts on where bitcoin might go from here:

With interest rates going up and global markets facing uncertainty, current economic conditions are epitomizing why bitcoin was created. Bitcoin is increasingly resistant to turmoil in the traditional markets and imminent regulatory scrutiny.

The recent blackout on Instagram and Facebook also demonstrated the world’s unfortunate dependence on centralized systems – a testament to the popular adage that ‘bitcoin never goes down’. Our immense dependence on financial and technological systems underlain by faulty frameworks – whether that’s government money or traditional social networks – means that the fallibility of these systems will have increasingly dire consequences, underscoring the essence of why bitcoin, a fundamentally transparent, censorship-resistant and immutable currency, is unique – and how bitcoin adoption can transform our world.

Historically, we’ve seen bitcoin perform spectacularly in Q4 in past cycles. I’m pulling for a repeat performance.

Matt Senter, Co-founder and CTO of bitcoin rewards app, Lolli

Bitcoin crossing the US$55,000 mark today underlines a growing recognition that the world’s biggest cryptocurrency is the answer as the velocity of money keeps dropping while the astronomical levels of debt continue to rise. It is of course a matter of speculation if we will soon see a crash in stocks or property. What is certain is that money printing hasn’t made a substantial impact on the real economy. Rather it has contributed to the rich getting richer and the poor and middle classes getting poorer.

Meanwhile, digital assets are still in their nascent stages of development while bitcoin has only recently started to get wider recognition as a form of digital gold. Younger generations and millennials are intuitively seeing the value in investing in bitcoin and cryptocurrencies. Implicit in this is a recognition that these digital assets could counter harsh societal inequalities that have only been exacerbated during the pandemic.

Bitfinex Trading Team

Bitcoin price gains top 10 per cent in 24 hours

Wednesday 6 October 2021 16:37 , Anthony Cuthbertson

Bitcoin is now up 10 per cent in just the last 24 hours. Yet even such a dramatic price surge appears relatively modest when put in context.

Here’s how the cryptocurrency’s price has changed when looking back even further:

1 day: +10%

1 week: +30%

1 year: +414%

5 years: +8,770%

10 years: +2,749,900%

Could Brazil be next to embrace bitcoin?

Wednesday 6 October 2021 15:39 , Anthony Cuthbertson

After El Salvador became the first country in the world to adopt bitcoin as legal tender, people are wondering who might be next.

If recent murmurings south of the equator are to be taken seriously, the next country to take the plunge could be Brazil - the world’s 12th largest economy.

A cryptocurrency regulation bill is expected to be presented to the Plenary of the Chamber of Deputies this week, which if successful could allow Brazilians to buy everything from houses to groceries with bitcoin.

We’ve heard from Paolo Ardoino, the chief technology officer of the Bitfinex cryptocurrency exchange, about how significant such a move would be.

“The prospect of Brazil embracing bitcoin as legal tender would mark a monumental moment in adoption,” he said.

“There will still be hurdles to creating an infrastructure that functions in a fast and efficient way. As payment networks grow larger - in the case of Brazil it would be a country with a population of over 200 million people - enabling faster transactions among participating nodes becomes a major pain point. Most of the day-to-day use of bitcoin will need a second layer technology like the Lightning Network, a solution to solve the bitcoin scalability problem.”

Bitcoin price on the charge once again

Wednesday 6 October 2021 14:49 , Anthony Cuthbertson

Bitcoin is seeing another price spurt, rising above $55,000 for the first time since May. It is now less than $10,000 away from the all-time high it hit in mid April.

The price surge has taken its market cap above $1 trillion and provided a major boost to the overall crypto market.

Ethereum (ether) is now back above $3,500, while dogecoin is now closer to $0.30 than $0.20, having lingered below $0.25 for several weeks. Every single one of the top 10 most valuable cryptocurrencies are now in the green on both a 24 hour and seven day timeframe.

Bitcoin price to see ‘very significant moves to the upside'

Wednesday 6 October 2021 11:03 , Anthony Cuthbertson

A key metric for estimating price movements is the supply of bitcoin held by long-term holders.

Of the 18.78 million bitcoins that currently exist, 13 million - or 69 per cent - of them are currently held by people who have held them for 12 months or longer.

“Tracking this metric is important as it clearly highlights times of tight supply, which are often highly correlated with significant future price appreciation,” Will Hamilton, head of trading and research at digital asset management firm TCM Capital, told The Independent.

“More and more investors are buying and holding, which should translate into higher prices. All things considered, we think Q4 will see some very significant moves to the upside for the market as a whole.”

Bitcoin price recovery divides analysts

Wednesday 6 October 2021 10:23 , Anthony Cuthbertson

Is bitcoin’s remarkable recovery the second leg of a bull run or just a “dead cat bounce” before plummeting once again?

This is the question currently dividing crypto market analysts, with adherents to the first theory believing bitcoin is set to hit new all-time highs within the next couple of months. Those most optimistic see bitcoin hitting six figures before Christmas.

One analysts has drawn comparisons to similar market patterns seen in 2017, when bitcoin quadrupled in price between early October and December.

Incredible to think how much time we've spent analyzing short-term #Bitcoin price action since June, when all we needed to do was copy-paste 2017. pic.twitter.com/wtXma7tosU

— TechDev (@TechDev_52) October 6, 2021

Others have pointed to a likeness to the descent from the dotcom bubble bursting in the early 200s.

Looks familiar... #Bitcoin pic.twitter.com/2xwMpK5gme

— Mr. Whale (@CryptoWhale) October 6, 2021

The two diverging theories put bitcoin either at a fraction of its current price by 2022, or several multiples higher than it.

Should bitcoin rise another $14,000 over the coming weeks, the dead cat bounce theory will be disproved. However it will need to fall to well below $30,000 for the price rally theory to be dismissed.

Bitcoin price holds firm above $50k

Wednesday 6 October 2021 09:32 , Anthony Cuthbertson

The price of bitcoin has managed to hold above $50,000, reaching as high as $51,839 on Wednesday morning, according to CoinMarketCap’s price index.

It’s now up more than 20 per cent week-on-week, while bitcoin’s market cap is steadily closing in on $1 trillion. The last time it was above this landmark was way back in May.

Bitcoin’s resurgence may have boosted the likes of Ethereum (ether) and dogecoin, but not all leading cryptocurrencies have seen a price rise overnight. Solana (SOL) fell by nearly 10 per cent, dropping it back below Ripple (XRP) in terms of overall market cap.

Bitcoin blasts past Facebook

Tuesday 5 October 2021 13:06 , Anthony Cuthbertson

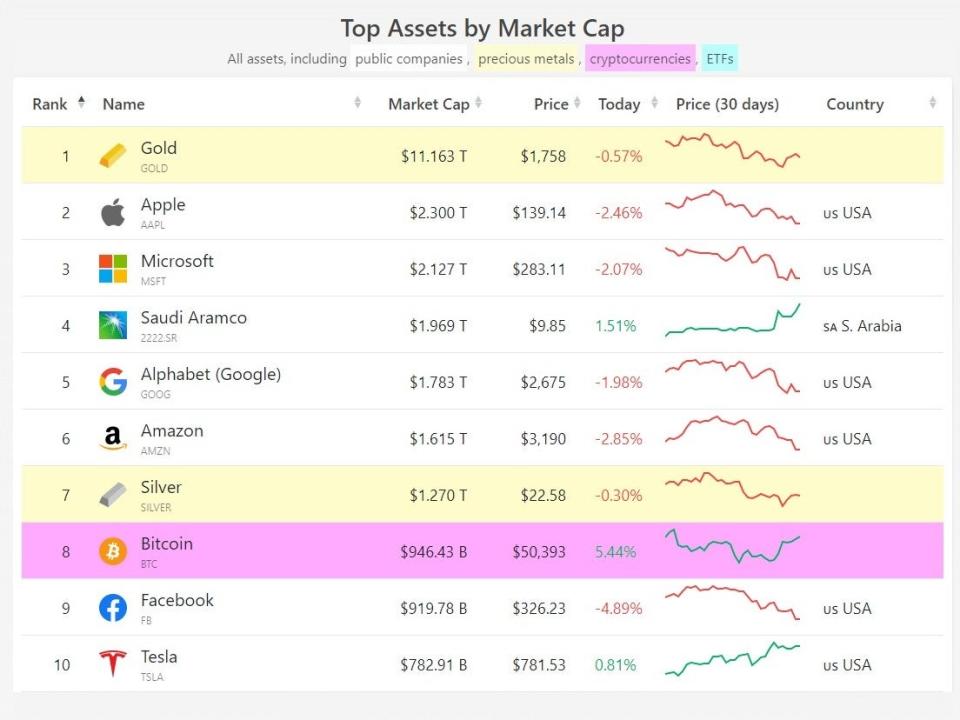

Bitcoin’s latest price surge has pushed its market cap above Facebook’s.

During its record-breaking price rally earlier this year, bitcoin briefly rivalled the market value of silver, while the overall crypto market surpassed the entire worth of Apple, the world’s most valuable company.

It’s still a long, long way from gold, which has a market cap more than 10-times that of bitcoin’s. Some high-profile investors, such as Tim Draper, believe bitcoin could eventually reach these heights, meaning a single bitcoin would be worth more than half a million dollars.

Bitcoin price back above $50k

Tuesday 5 October 2021 12:46 , Anthony Cuthbertson

After a day of steadily climbing in price, bitcoin has finally risen above $50,000. It is the first time the cryptocurrency has peaked above this milestone since early September, and means bitcoin is now up more than 18 per cent since the start of October.

We’ve heard from some experts and analysts, who offer their thoughts on what’s behind this latest price surge, as well as speculate on where it might go from here.

You can read the full story here.

Bitcoin price breaks $50k, surpassing Facebook’s market value

Hello and welcome...

Tuesday 5 October 2021 12:30 , Anthony Cuthbertson

to The Independent’s live coverage of the crypto market. We’ll be bringing you all the latest news, updates and analysis from bitcoin, Ethereum (ether) and the rest of the cryptocurrency space.

money

money