Bill Ackman Expands Howard Hughes Exposure

- By Sydnee Gatewood

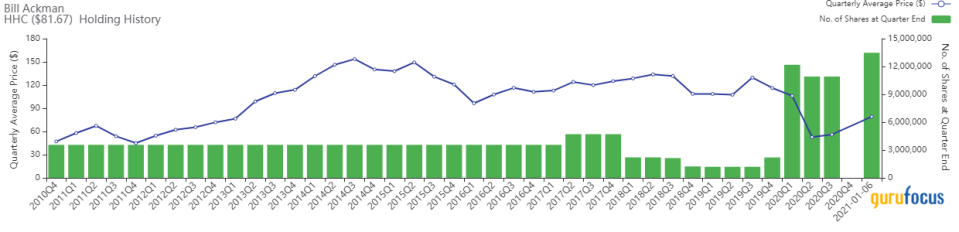

Billionaire investor Bill Ackman (Trades, Portfolio) disclosed late last week he boosted Pershing Square Capital Management's stake in The Howard Hughes Corp. (NYSE:HHC) by 23.37%.

The guru's New York-based hedge fund is known for taking large positions in a handful of underperforming companies and pushing for change in order to unlock value for shareholders. While he has found success recently with Chipotle Mexican Grill Inc. (NYSE:CMG) and Starbucks Corp. (NASDAQ:SBUX), one of Ackman's most well-known activist targets, which did not end well for him, was Valeant Pharmaceuticals. He also pursued an unsuccessful short of Herbalife Nutrition Ltd. (NYSE:HLF), which he bowed out of in 2018.

According to Real-Time Picks, a Premium GuruFocus feature, Ackman invested in 2.5 million shares of Howard Hughes on Jan. 6, impacting the equity portfolio by 2.24%. The stock traded for an average price of $79.12 per share on the day of the transaction.

He now holds 13.5 million shares of The Woodlands, Texas-based real estate company, which account for 11.81% of the equity portfolio. GuruFocus estimates Ackman has lost 5.21% on the investment since establishing it in the fourth quarter of 2010.

A major real estate development and management company, Howard Hughes has a $4.53 billion market cap; its shares were trading around $82.39 on Monday with a price-book ratio of 1.23 and a price-sales ratio of 5.08.

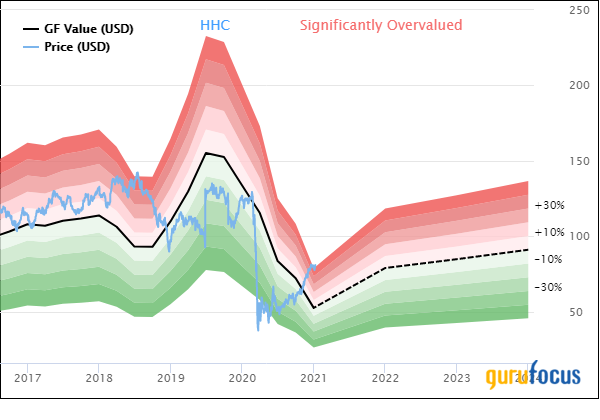

The GF Value chart indicates the stock is significantly overvalued currently. The GuruFocus valuation rank of 7 out of 10, however, leans more toward undervaluation even though the price-sales ratio is approaching a two-year high.

In Pershing Square's semiannual shareholder letter, Ackman wrote that the Covid-19 pandemic "initially had a draconian effect" on the company.

"Rent collections declined dramatically, lot sales came to a halt, and buyers of assets that HHC had been marketing for sale walked away from contract negotiations, and/or reduced bids dramatically," he wrote.

In response, the board and management team worked to stabilize the balance sheet by raising $600 million worth of equity in March. In order to protect its existing investment in the stock as well as benefit from an eventual recovery, Pershing Square committed $500 million of capital in the offering.

"We believe the impact of the pandemic on HHC's assets is, for the most part, transitory, and has largely overshadowed the significant progress the company has made on its transformation plan announced last October," Ackman wrote. "Management has taken meaningful steps to reduce overhead expenses and transition to a more decentralized operating model focused around its core MPCs. These actions have enabled HHC to react more nimbly and efficiently in the current environment. We expect the company to reengage on its plan to dispose non-core assets when market conditions stabilize."

GuruFocus rated Howard Hughes' financial strength 3 out of 10. As a result of issuing approximately $1.6 billion in new long-term debt over the past three years, the company has weak interest coverage. The low Altman Z-Score of 0.76 also warns it could be in danger of going bankrupt if it does not improve its liquidity position.

The company's profitability scored a 5 out of 10 rating on the back of declining margins and negative returns that underperform a majority of competitors. Howard Hughes also has a low Piotroski F-Score of 1, indicating poor business conditions, and its predictability rank of one out of five stars is on watch as a result of operating income losses and slowing revenue per share growth over the past several years. GuruFocus says companies with this rank return an average of 1.1% annually over a 10-year period.

Ackman is by far Howard Hughes' largest guru shareholder with a 24.53% stake. Murray Stahl (Trades, Portfolio), Barrow, Hanley, Mewhinney & Strauss, Donald Smith and Jim Simons (Trades, Portfolio)' Renaissance Technologies also own the stock.

Portfolio composition and performance

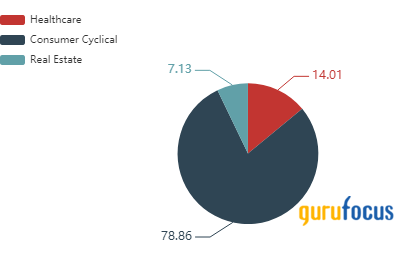

The majority of Ackman's $8.82 billion equity portfolio, which was composed of seven stocks as of the third quarter, is invested in the consumer cyclical sector. The health care and real estate spaces have much smaller representations.

The guru's other holdings as of Sept. 30 were Lowe's Companies Inc. (NYSE:LOW), Chipotle, Restaurant Brands International Inc. (NYSE:QSR), Agilent Technologies Inc. (NYSE:A), Hilton Worldwide Holdings Inc. (NYSE:HLT) and Starbucks.

In its monthly report for December, Pershing Square recorded a net performance of 4.6% for the month and a year-to-date net performance of 70.2%.

Disclosure: No positions.

Read more here:

Bill Miller Says Bitcoin Gets Less Risky the Higher It Goes

Primecap Curbs Holdings of Cree, BioMarin Pharmaceutical

Chuck Royce's Firm Closes Out 2020 by Slashing 3 Holdings, Adding to 1 Stake?

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

money

money