Biden's 'noble' plan for Social Security wouldn't solve all funding problems

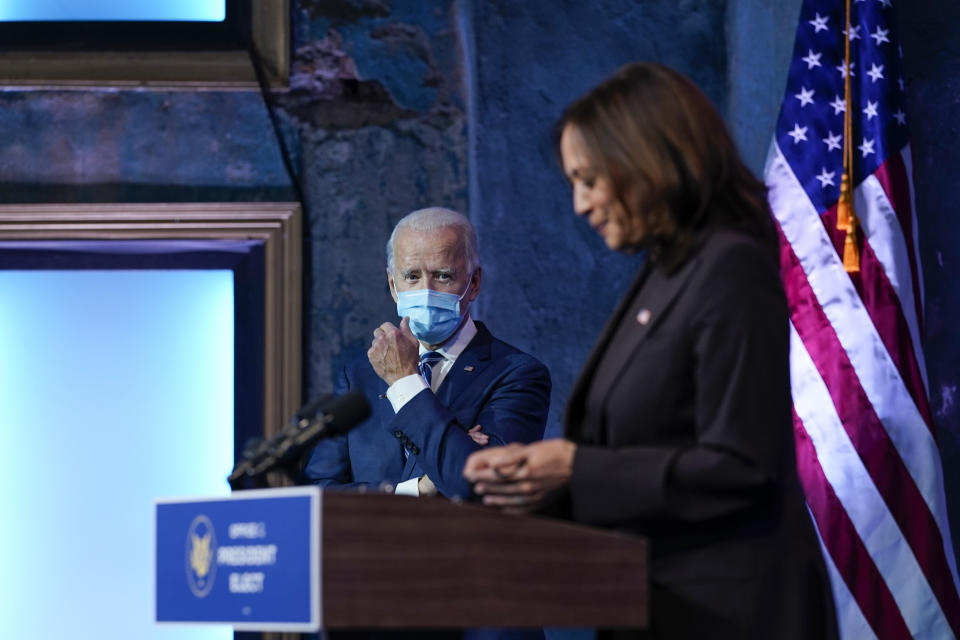

As President-Elect Joe Biden prepares for his first year in office, he’ll have to grapple with the future funding problems facing Social Security and how to insure financial security for older Americans.

From imposing a new 6.2% Social Security tax on earnings above $400,000 to increasing minimum benefits to 125% of the federal poverty level, Biden’s plan — while comprehensive — falls short of solving the biggest issues with Social Security.

But it would lift an estimated 1.4 million Americans out of poverty — only if it can manage to pass Congress.

“Biden’s plan is a noble one, designed to pay more to those who need it most, prevent elder poverty, and provide people with a basic safety net beyond what it does today,” said Chad Parks, CEO of Ubiquity Retirement + Savings, a financial firm. “He intends on paying for these increased benefits with an increase in tax revenue from those earning over $400,000, but it does not do enough.”

Biden’s plan will cover some, but not all, of Social Security’s shortfall

The fund that pays out Social Security benefits is largely funded by a payroll tax, plus earned interest on accumulated reserve holdings, invested in Treasury securities. For decades, the money from the payroll taxes more than covered the benefits the fund paid out, creating a surplus.

But as the workforce shrunk and the number beneficiaries increased, the money from payroll taxes doesn’t fully cover the benefits paid out, eroding that surplus. The surplus is expected to be depleted by 2035, meaning that payroll taxes collected then will cover 75% to 80% of benefits.

Biden’s new 12.4% tax on earnings above $400,000 would increase the revenue the payroll taxes bring in, collecting 7% more in revenue in 2021, 12% more in 2040, and 16% more in 2065 than under current law, according to a recent analysis from the Urban Institute.

“Currently, most of Social Security’s revenue comes from a 12.4% payroll tax that is split between workers and their employers on earnings up to $137,700 in 2020, said Luke LLoyd, wealth advisor and investment strategist at Strategic Wealth Partners, a financial firm. “The second tax will cover some, but not all, of the deficit.”

Biden’s Social Security plan also doesn’t extend the depletion date as far as needed, according to Parks.

“In Biden’s plan, the surplus is expected to be depleted in 2040,” Parks said, “only five more years from today’s expected depletion date in 2035.”

The extra revenue also goes to other key Social Security changes that Biden proposes. These include providing a higher benefit for those working at least 20 years, providing benefits for teachers who already have a pension plan, increasing benefits for widowed spouses, and providing earning credits to caregivers who care for children younger than 12 years old and/or family members with disabilities.

His plan likely will face opposition in Congress

One roadblock will be the effects of implementing higher taxes, typically an anathema to Republicans who could control the Senate depending on the outcome of two runoff races in Georgia in January.

“Higher tax rates can discourage work, saving, investment and innovation,” Lloyd said. “It’s important to find a healthy solution that will continue to drive long-term economic investment and innovation.”

Parks said higher income earners likely won’t support the plan’s structure.

“In essence, [he’s] giving earners a break up to the $400,000 mark,” Parks said. “Even though this is a reasonable approach, it really hits hard on those earning over $400,000 and it is indicated they will not get any additional benefit accrual for the additional contribution.”

While it’s a positive move by Biden to propose a Social Security solution for all Americans, any implementation will take time.

“We still have a split government and an exploding deficit,” said Tyler End, CEO of Retireable, a financial advice platform. “We will need to keep a close eye on Senate Republicans and how aggressive they are in blocking additional spending, because it could prevent Social Security from receiving the influx of funding it needs.”

Dhara is a reporter Yahoo Money and Cashay. Follow her on Twitter at @Dsinghx.

Read more:

Retirement: Average Boomer's savings would only last seven years, study finds

Biden's Social Security and SSI plan would lift 1.4 million out of poverty, study finds

Social Security 'insurance:' Company offers product to protect against surplus running out

Most Americans didn’t tamper with their retirement savings even in pandemic, study finds

Read the latest financial and business news from Yahoo Finance and Yahoo Money

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money