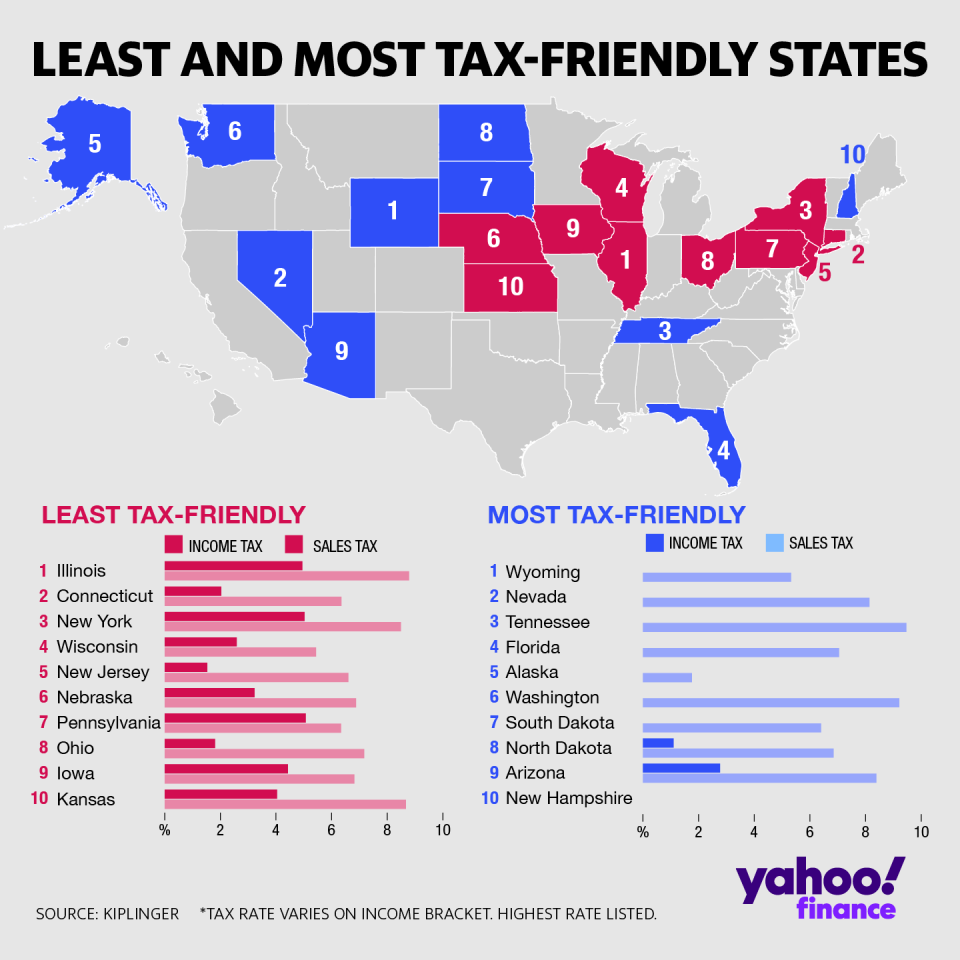

These are the best and worst states for taxes in 2019

Improving your personal bottom line may be easier if you avoid the New York City metro area, where some of the least tax-friendly states are located.

To get better tax treatment, head west to Nevada, Washington, Arizona or Alaska, according to a recent analysis from Kiplinger. The friendliest state – tax-wise – is Wyoming for a host of reasons.

The state has no income tax and a low tax on gasoline, thanks to the revenue it receives from oil and mineral rights. The state also has the third-lowest sales tax rate of all the states with this tax at 5.32% and the ninth-lowest property tax in the nation.

An additional perk in Wyoming, especially for college students? It has the lowest beer tax in the U.S. at 2 cents per gallon.

Nevada, another haven from income taxes, comes in second in tax friendliness. Its property taxes are among the lowest in the U.S., and state law limits annual property tax increases on homeowners to 3%.

State with high taxes

On the other end, Illinois leads the least tax-friendly states, according to Kiplinger. It charges the second-highest property tax and the seventh-highest state and local sales tax at 8.78%.

The Prairie State also has the highest tax on wireless cell phone service at 20.91%. Including federal taxes and fees, a Chicago family that pays $100 a month for four cell phone lines has a $500 tax bill for those services each year, according to the Tax Foundation.

Clustered around New York City are several of the least-tax friendly states. Connecticut and New York come in at Nos. 2 and 3.

New Jersey – the fifth-worst state for taxes overall – charges the highest property tax in the country of $2,530 per $100,000 in home value. But, to its credit, the Garden State has a favorable income tax.

Pennsylvania – ranked No. 7 on the least-friendly list – has a flat 3.07% income tax rate that seems low. But most of the state’s cities and towns add on their own local income tax, making the Keystone State’s effective income tax rate even higher. The state also has the second-highest state gas tax in the U.S. at 58.7 cents a gallon.

To create its ranking, Kiplinger considered income tax; property tax; sales tax; fuel taxes; taxes on tobacco, alcohol and vapor products; inheritance and gift taxes; and wireless tax.

Denitsa is a writer for Yahoo Finance. Follow her on Twitter @denitsa_tsekova.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money