Banks are closing credit cards and slashing credit limits amid the pandemic, survey finds

As the economic fallout of the pandemic continues to unfold, banks are rushing to close credit card accounts or slash credit limits to curb their risk.

One in 4 Americans with credit cards said they had an account involuntarily shut down from mid-May to mid-July, while 1 in 3 said their credit limit was reduced, according to a new report from CompareCards.com that surveyed 1,003 credit cardholders.

This follows a similar rate of reductions in April and comes as many Americans battle joblessness and uncertain economic futures, but now with reduced access to credit.

“These are really big numbers,” said Matt Schulz, chief industry analyst at CompareCards. “It means that an awful lot of Americans had one of their financial security nets taken out from under them in one of the most difficult economic times in American history.”

Read more: Coronavirus: What it means if your lender cuts your credit card limit

The pullback by credit card issuers is occurring more frequently than in 2008 during the Great Recession, when 1 in 6 cardholders reported reduced limits or involuntary account closures, according to a 2010 study by Phoenix Synergistics, a market research firm for financial services companies.

“This is, in a lot of ways, a much bigger issue today than it was in the Great Recession,” Schulz said. “It makes sense that banks are taking an even harder line with lending because there's so much that they don't know, and they're so nervous about risk.”

1 in 5 cardholders saw a credit decrease of at least $5,000

While most credit limits were reduced by $1,000 or less, more than 1 in 5 cardholders said their limits were slashed by at least $5,000.

“Folks who saw the biggest credit limit reduction were high-income folks,” Schulz said. “They’re more susceptible to credit limit cuts, simply because they will be the most likely to have high credit limits in the first place.”

Americans making more than $100,000 were the most likely to have their credit limit cut. Two in 5 reported that happened to them.

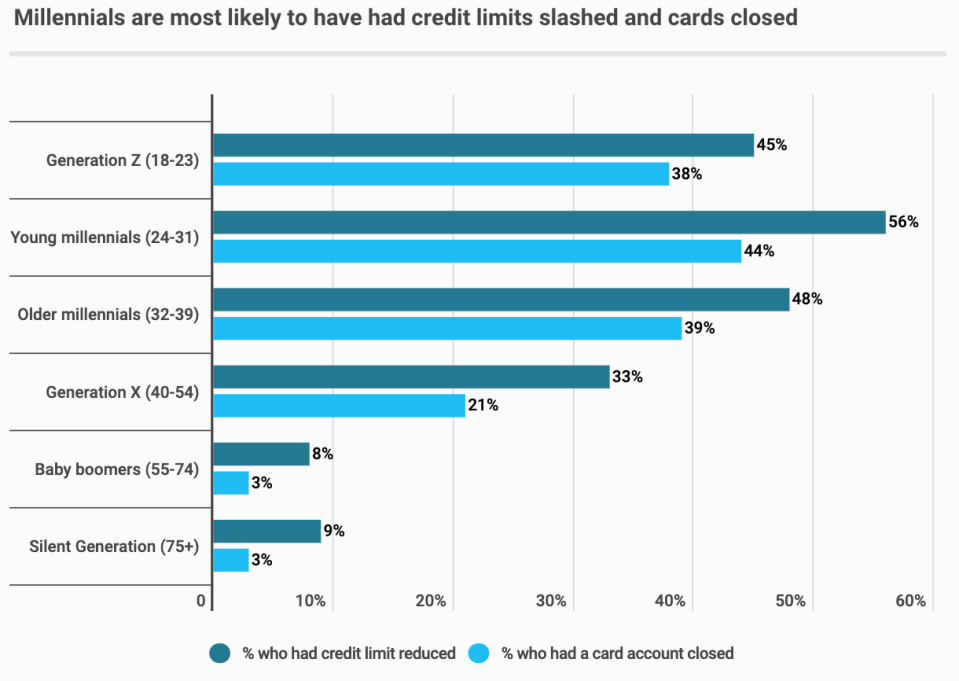

Young millennials were the most likely to be affected among the generations, the report found. Four in 9 young millennials, currently between 24 and 31, had a card closed, while 5 in 9 had their credit limit reduced.

“We know an awful lot of millennials got very enthusiastic about credit card rewards over the last few years,” Schulz said. “So they may have a few cards in their wallet that they haven't used in a while.”

Read more: What to do if you’re denied a new credit card

A reduced credit limit likely will ding your credit score. That’s because it increases your utilization rate — by lowering the amount of available credit that you have— the second-most important factor in credit scoring.

“It doesn't take much to really impact your utilization rate, and potentially really hurt your credit score,” Schulz said.

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Rich Americans' pullback in spending is hurting the economic recovery

'Nobody can survive on that': Jobless Americans fear end of extra unemployment insurance

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money