AOC: 'Y’all, the billionaires are asking for a safe space'

Several billionaires have recently criticized the wealth tax proposal of presidential candidate Sen. Elizabeth Warren (D-MA). And fellow lawmaker Rep. Alexandria Ocasio-Cortez (D-NY) has come to her aid.

During an interview with CNBC, JPMorgan CEO Jamie Dimon said of Warren: “She uses some pretty harsh words, you know, some would say vilifies successful people.”

The New York congresswoman, who previously proposed a 70% tax on Americans with incomes over $10 million, jumped on Dimon’s remarks:

Y’all, the billionaires are asking for a safe space - you know, in addition to the entire US economy and political lobbying industry. https://t.co/oJR8SZz9gJ

— Alexandria Ocasio-Cortez (@AOC) November 6, 2019

‘I’ve paid over $10 billion in taxes’

From Microsoft Founder Bill Gates to Leon Cooperman, the rich are continuing to worry about the impact of Warren’s rhetoric against the wealthy and argued that her proposed tax structure is going to stifle innovation.

Warren’s plan hopes to enact a new annual tax of 2% on every dollar a household has above $50 million, which increases to 6% for households with more than $1 billion. She has stressed that the revenue generated for her wealth tax would go towards other federal programs, like Medicare for All and her plan to expand Social Security.

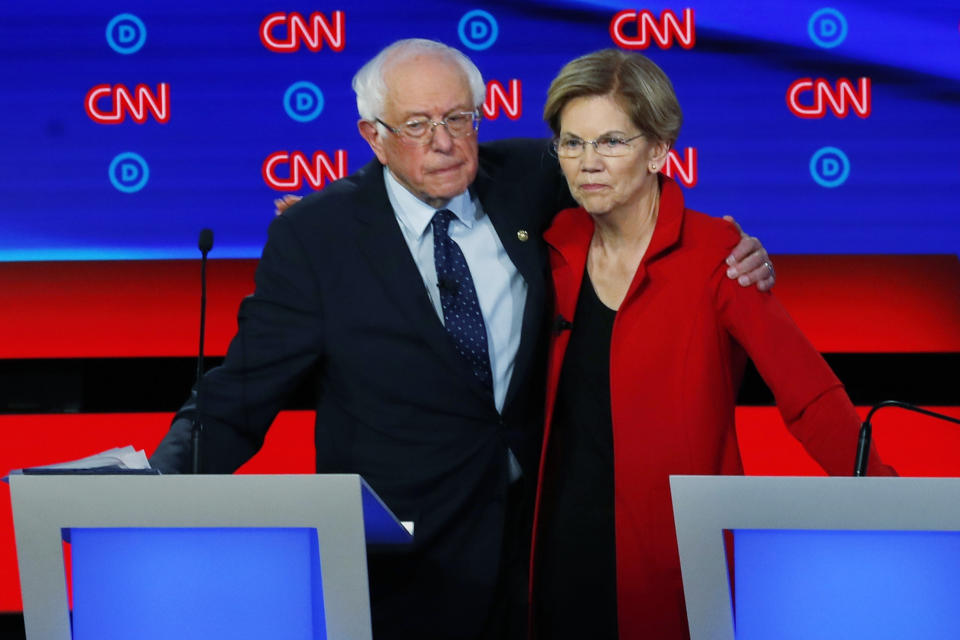

Warren is not the only candidate to propose a wealth tax — Sen. Bernie Sanders (I-VT) unveiled his ‘Tax on Extreme Wealth’ plan back in September. His proposal would place a 1% tax on the top 0.1% of American households. The tax “would start with a 1 percent tax on net worth above $32 million for a married couple,” according to the release. “That means a married couple with $32.5 million would pay a wealth tax of just $5,000.”

The tax rate under Sanders’ plan would increase to 2% on households with new worth between $50 million and $250 million, 3% on net worth up to $500 million, 4% on new worth up to $1 billion, and so on up to a 8% tax on wealth over $10 billion.

Gates lamented that that while he was “all for super progressive tax systems,” he warned that high levels of taxation could risk capital formation, innovation, and America’s desirability as a hub of innovation for companies. (Former Secretary of State Hillary Clinton called them “unworkable.”)

“I've paid over $10 billion in taxes,” the Microsoft (MSFT) co-founder said during the New York Times DealBook Conference on Wednesday. “If I'd had to pay $20 billion, it's fine. But when you say I should pay $100 billion, OK then I'm starting to do a little math about what I have left over. You really want the incentive system to be there, and you can go a long ways without threatening that.”

Dimon concurred: “I think we have to look at [how] America was founded on free enterprise; freedom and free enterprise are interchangeable... If people have very specific things that we should do different, [then] we should think about doing them different.”

There is growing support for taxing the wealthy. A poll from Politico/Morning Consult found that 76% of registered voters think wealthy Americans should pay more taxes. And, a Fox News survey found that 70% of Americans, including 54% of Republicans, are in support of raising taxes on those who earn more than $10 million.

After Warren responded to his comments, assuring him that his tax bill would not be $100 billion, Gates tweeted at her to show his general support for the idea: “I greatly respect your commitment to finding ways to address wealth inequality and poverty at home. While we may disagree about some of the ways to get there, we certainly agree we need a lot of smart people committed to finding the path forward.”

‘If they would have had the level of success that I and others have had...’

Other billionaires have also poured cold water over the plan, doubting whether it would even take off.

“I don’t think all of a sudden a wealth tax, for example, would solve all of our society’s problems, if one could ever actually be implemented,” David Rubenstein, Co-Founder of the The Carlyle Group told CNBC on Tuesday at the Greenwich Economic Forum.

Billionaire Mark Cuban also weighed in on the issue in a previous interview with Yahoo Finance, implying that had Sanders, Warren, and Ocasio-Cortez been as successful as him, they might not have as much to say about the ultra-wealthy.

“Bernie Sanders has a book business, you know, Elizabeth Warren buys and sells houses — or did,” Cuban said. “If they would have had the level of success that I and others have had, I don’t think they’d be complaining as much.”

And in any case, former New York City Mayor Michael Bloomberg said in January that Warren’s tax was “probably unconstitutional.”

“People earn money to pay their taxes, and then they don’t expect the government to come back and take some of it away,” he added. “I think you can question whether or not we have the right tax rates.”

—

Aarthi is a writer for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Adriana is an associate editor for Yahoo Finance. She can be reached at adriana@yahoofinance.com. Follow her on Twitter @adrianambells.

Read more:

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money