America's lowest earners are powering the economy: Morning Brief

Wednesday, November 20, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

More wages, more spending, more growth

You've heard the story by now: the current economic expansion hinges on the health of the U.S. consumer.

Of course, this is basically true all the time — consumer spending accounts for about 70% of GDP growth.

But right now, investors see slowing manufacturing activity, slowing corporate investment, and slowing global growth as putting even more pressure on U.S. consumers to keep this thing going. And according to data from Bank of America Merrill Lynch published Tuesday, it is consumers at the lowest end of the wage scale that are increasingly carrying the load.

Citing Bank of America debit and credit card data, BAML analysts led by Robert Ohmes found that spending for consumers earnings less than $50,000 a year grew 5% over last year in October. Consumers making between $50,000-$125,000 grew spending a bit less than 4% while upper income consumers grew spending around 2% last month.

In other words, the health of this expansion rests on the economy’s lowest earners.

Now, October's relationship between low and high income consumers isn't necessarily new. Low income consumers have been increasing spending markedly faster than higher income consumers since the summer of 2018, according to BAML's data.

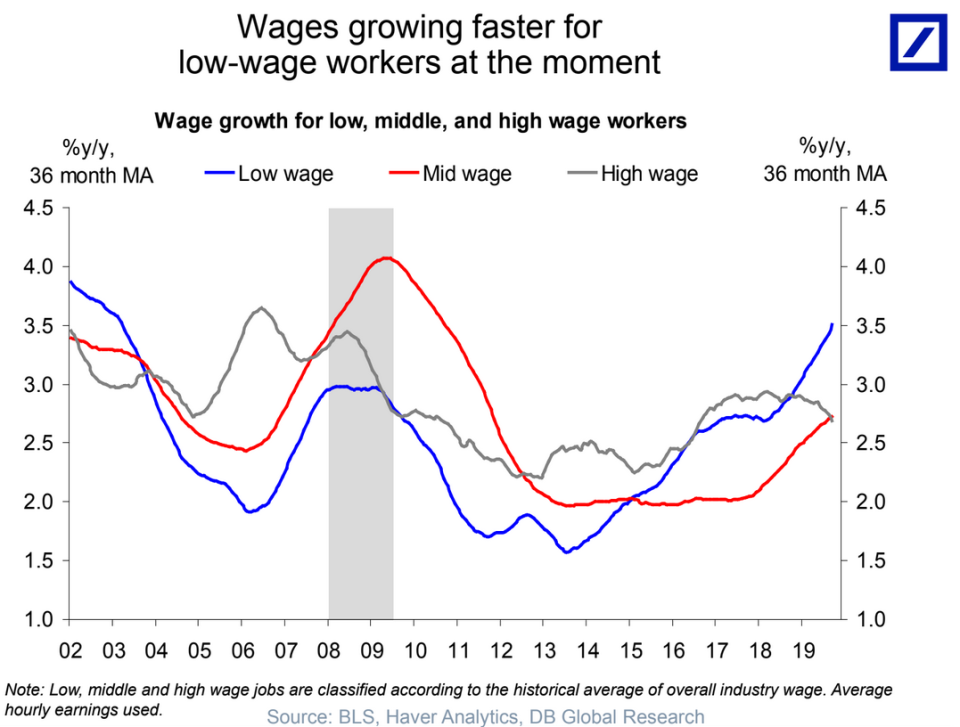

Lower income consumers are also seeing bigger gains in the labor market than their high-income peers. According to data from Deutsche Bank, average wage growth for low wage workers are up about 3.5% over the last two years and this cohort has seen wages grow faster than mid- and high-wage earners for most of the last two years.

And all else equal, lower income consumers will have a higher marginal propensity to consume than those who earn higher wages, as each new dollar of income accounts for a larger percentage increase in overall compensation for lower earners.

The increasing fortunes of lower earners is something Federal Reserve Chair Jerome Powell has noted in recent public statements and bolsters his view that easier Fed policy has broader economic implications than simply supporting asset prices.

"The improvement in the jobs market in recent years has benefited a wide range of individuals and communities," Powell said in testimony delivered on Capitol Hill last week. "Indeed, recent wage gains have been strongest for lower-paid workers. People who live and work in low- and middle-income communities tell us that many who have struggled to find work are now getting opportunities to add new and better chapters to their lives."

At a September press conference, Powell said these lower income wage gains, "[underscore], for us, the importance of sustaining the expansion so that the strong job market reaches more of those left behind."

Of course, not everyone agrees that an economy reliant on its lowest earners to keep increasing their spending stands on solid footing.

"Given the economy's over reliance on consumer spending, U.S. growth has become increasingly fragile," said economists at Oxford Economics in a note published late last week. “A slower pace of consumer outlays ought to be expected in an environment of cooler job creation, decelerating income growth and elevated policy uncertainty,” the firm added.

In Oxford’s view, GDP growth in the fourth quarter is likely to hit an annualized pace of just 1.3%.

But consumer balance sheets are still in good shape and the benefits of this expansion are accruing fastest to those who felt the impacts from the last recession most acutely. A group now carrying the economic expansion into a new decade.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him @MylesUdland

What to watch today

Economy

7 a.m. ET: MBA Mortgage Applications, week ended November 15 (9.6% prior)

2 p.m. ET: Federal Open Market Committee (FOMC) October meeting minutes

Earnings

Pre-market

6 a.m. ET: Lowe’s (LOW) is expected to report adjusted earnings of $1.35 per share on $17.70 billion in revenue

6:30 a.m. ET: Target (TGT) is expected to report adjusted earnings of $1.19 per share on $18.22 billion in revenue

Post-market

4:30 p.m. ET: L Brands (LB) is expected to report adjusted earnings of 2 cents per share on $2.69 billion in revenue

Other notable reports: Sonos (SONO)

Top News

US Senate unanimously passes measure backing Hong Kong [Bloomberg]

Alibaba guides pricing on Hong Kong listing around $11.2B [Bloomberg]

DoorDash considers direct stock listing instead of IPO [Bloomberg]

YAHOO FINANCE HIGHLIGHTS

Why Fox's attempt to trademark 'OK Boomer' could backfire

Twitter users explain why Kohl's stock just got obliterated after reporting earnings

Beyond botched meth PSA, South Dakota has a problem

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money