Almost a third of Americans say they may never retire because of coronavirus hardships

The pandemic’s crushing blow on the economy is derailing most Americans’ retirement plans, with a significant number worrying they won’t be able to retire at all.

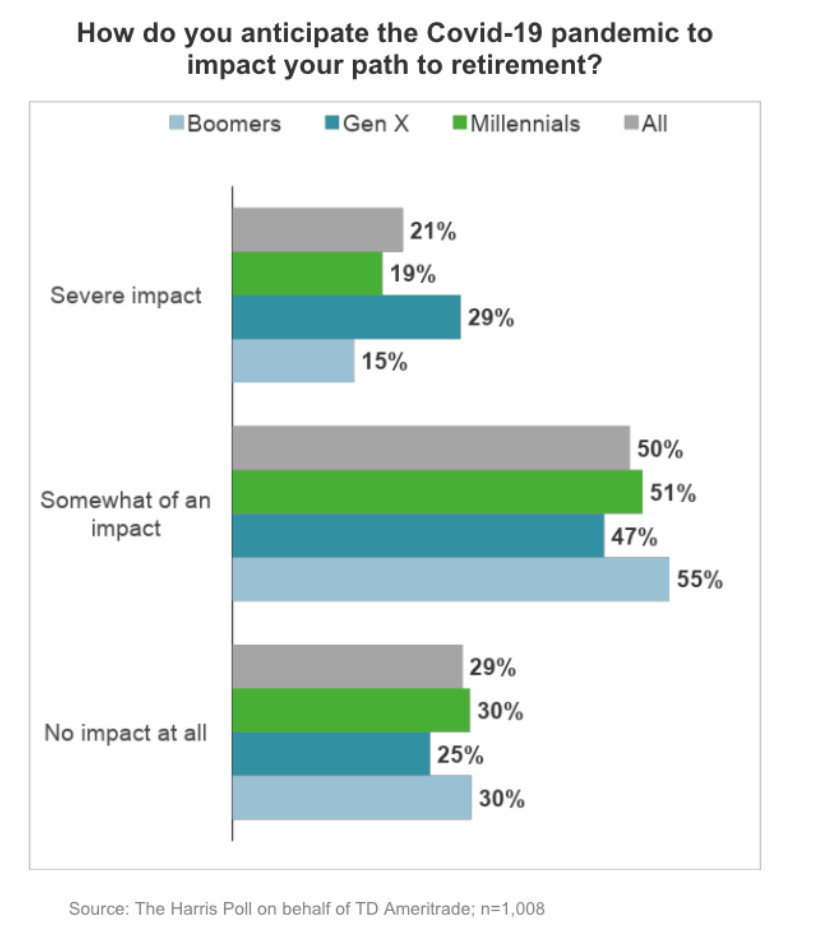

Seven in 10 Americans expect the pandemic to hurt their retirement savings, according to a new TD Ameritrade survey, with a fifth predicting a severe impact. Nearly a third, or 30%, of Americans feel like they won’t ever retire, the survey found.

Read more: How to stay on track for early retirement despite the coronavirus pandemic

The outbreak is exacerbating the ongoing retirement saving crisis in the U.S. that existed well before the disease spread throughout the country.

“Unfortunately, this is not surprising. Before this economic fallout, Americans were already ill-prepared for financial emergencies,” said Steven Sexton, CEO of Sexton Advisory Group, a financial firm. “Living paycheck to paycheck and incurring unmanageable debt was already the reality for Americans before the virus hit. The pandemic has only magnified these financial issues on a much larger scale.”

Still recovering from the Great Recession

These findings come when more than 4 in 10 Americans were still recovering from the last recession, according to the study.

Almost 3 in 10 Gen Xers predicted a severe impact on their retirement, compared with 19% of millennials and 15% of boomers.

“What this virus has exposed is the lack of an emergency savings account and basic financial planning,” said Cathy Clauson, senior vice president of retirement services at AssetMark, an investment management firm. “Basic financial planning is essential in good and bad times. We just feel the pain of it missing in the bad times.”

Almost a third of Americans are also under the misconception that they have to pay back their stimulus check to the government, the survey found. Under the CARES Act, many Americans received up to $1,200 in relief money and an extra $500 per child under 17.

Read more: What happens when you drain your 401k retirement savings in your 20s

“There’s an opportunity to educate on legislation,” said Dara Luber, senior manager of retirement product at TD Ameritrade. “Americans think they have to pay back their stimulus check since they’re taught nothing comes for free.”

Many Americans also don’t know the new pandemic rules on taking money from your retirement savings. About a third believe it’s false that the CARES Act allows you to withdraw up to $100,000 penalty-free from your 401(k), according to the survey.

Making sacrifices for retirement

Americans are also prepared to make personal sacrifices to make up for losses in their retirement accounts.

Half are open to looking for a job in retirement to increase income and save costs. More than two-thirds of Gen Xers are considering this option, while almost 4 in 10 adults will or are thinking about delaying retirement altogether.

There are other ways to protect yourself for retirement.

“They could delay Social Security and go on to do a hobby and turn that into a second job,” Luber said.

‘Over time it is best to stay invested’

For those savers scrambling to withdraw from their retirement accounts out of fear, don’t, Clauson said. “Without a doubt, history shows us that over time it is best to stay invested,” Clauson said.

After seeing the impact of the coronavirus on their retirement savings, nearly 1 in 2 Americans have or are considering increasing their contributions to make up for lost savings, according to the survey. Gen X and millennials have the home-run advantage on this strategy, Luber said.

“It’s a good sign that they want to prioritize as they see it fit, but it’s really Gen X and millennials that will have a longer time horizon than baby boomers as they come out of the pandemic,” Luber said.

Dhara is a reporter Yahoo Money and Cashay. Follow her on Twitter at @Dsinghx.

Read more:

Empty nesters welcoming children back during the pandemic could hurt their finances

Millennials are most likely to raid their retirement accounts during the pandemic

Read the latest financial and business news from Yahoo Finance and Yahoo Money

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money