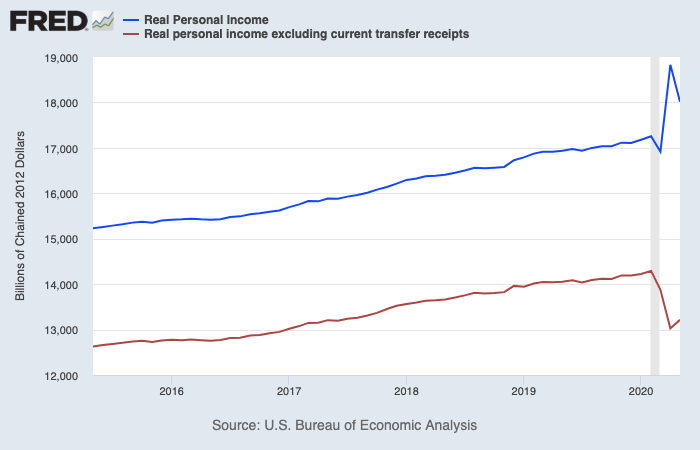

Americans' personal income drops without coronavirus stimulus payments

As the financial boost from the coronavirus stimulus checks faded in May, so did Americans’ personal income, according to a new government report.

Personal income fell by 4.2% in May, after a record increase in April of 10.5% that was largely because of the stimulus payments that 159 million Americans received, according to data by the Bureau of Economic Analysis. Disposable income also fell by 4.9% after a 12.9% increase in April.

“We got a one-time thing in April and it went away,” said Ernie Tedeschi, a managing director and policy economist for Evercore ISI. “We got about $600 billion [annualized personal income] in stimulus payments in May, far less than the $2.6 trillion we got in April. That $2 trillion difference explains most of why personal income went down.”

While personal income decreased in May, the level is still higher than pre-pandemic levels. That’s largely driven by government support, specifically the additional $600-per-week in unemployment benefits that jobless Americans are getting under the CARES Act.

“The emergency response of the federal government to the panic is working,” Tedeschi said. “We saw the stimulus check piece work well in April, and now we're seeing the unemployment insurance piece really bolster income in May.”

Read more: Coronavirus stimulus checks: Here's how people are spending their relief money

Additionally, the surprise decrease in the unemployment rate in May also helped keep personal income above pre-pandemic levels. While income coming from wages is lower than pre-pandemic levels, it did increase in May as employment grew.

“The good news that we saw in the May jobs report is reflected here,” Tedeschi said.

People are ‘very worried about the economy”

Consumer spending jumped by 8.2% in May — a record but missing estimates — while the savings rate declined to 23% from its record-high of 33% in April. Despite the increase in spending, consumers are still saving much more than before the pandemic, preventing overall expenditures from recovering.

“In May, the personal savings rate came down a bit, but it didn't completely reverse to where it was pre-pandemic,” Tedeschi said. “Part of the story, too, is precautionary savings. People are very worried about the virus, and they're very worried about the economy.”

The reopening of state economies also helped to propel the increase in spending in May. But, with states like Texas seeing a surge in coronavirus cases and shutting down parts of their economies, that may affect the level of future spending.

“Given that we're in the middle of re-closing some states, the sort of strong spending data that we saw reflected in the retail sales data and then reflected in the personal income report won't be as strong when we get the June data or the July data,” Tedeschi said.

No extension of unemployment ‘would be devastating’

Because consumer spending and personal income so heavily depend on government support, the recovery relies on what the government will do in the future.

Read more: Unemployment insurance: What it is and how to get it

Since the majority of stimulus payments have been distributed and the additional unemployment benefits are set to expire at the end of July, personal income may drop significantly and hurt future consumer spending.

Tedeschi estimated that personal income in August could fall by $700 billion If the unemployment benefits aren’t extending. The expiration of benefits will entirely erase the gains made in personal income since February.

“The emergency support expires on July 31,” Tedeschi said.“The cautionary tale is that if we don't do something to extend it in some way, shape, or form, that would be devastating to the families and to the U.S. economy over the summer.”

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Rich Americans' pullback in spending is hurting the economic recovery

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.

money

money