More Americans are taking on new debt for boats, motorcycles, and RVs

Some Americans who have remained gainfully employed during the pandemic are taking advantage of low interest rates to borrow money to finance big-ticket luxury items.

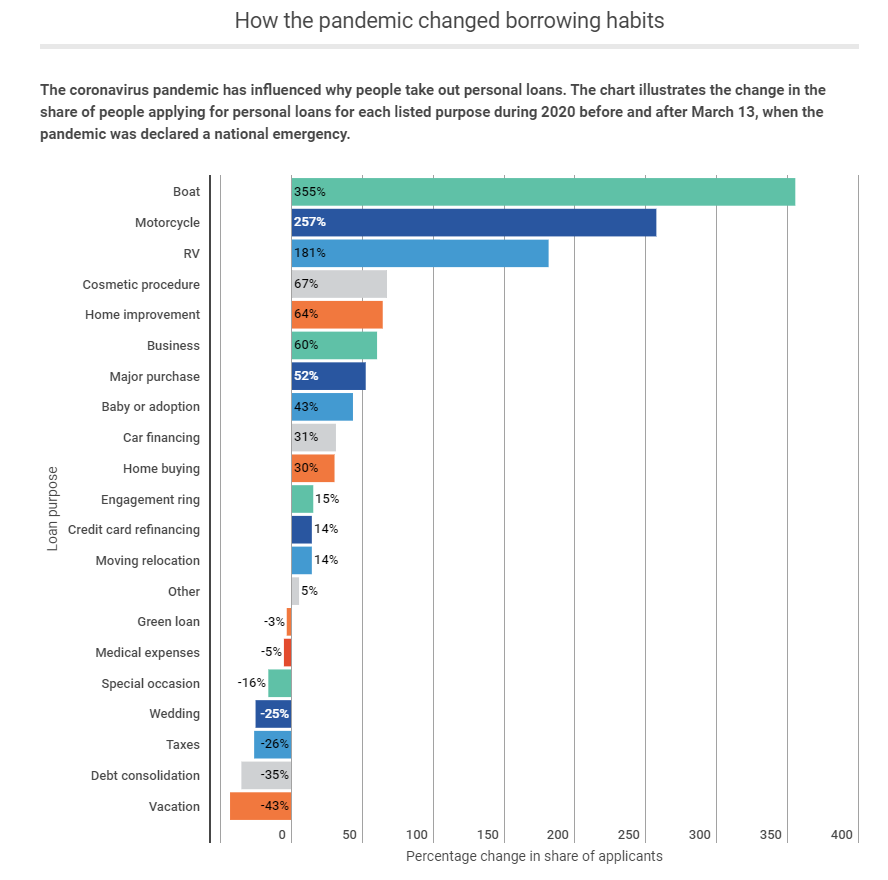

The number of loans taken out to buy a boat jumped 355% from before the pandemic and the increase was 257% for loans financing motorcycle purchases, according to a new analysis of data from Credible, an online marketplace for lending. The analysis included nearly 800,000 personal loan rate requests submitted to the Credible marketplace from Jan. 1 through Aug. 26, 2020.

Overall, loan applications for discretionary spending are up over 10% since the start of the pandemic.

“The percentage growth of those more discretionary purchases has increased substantially,” Rob Humann, Credible’s general manager, told Yahoo Money while noted that the overall number of loans for these purchases remain small. “Still, the predominant reason that people are taking out personal loans is to refinance their credit cards or to consolidate debt.”

Moves that ‘improve your personal financial health’

Not all Americans are splurging — major purchases accounted for just 8% of loan requests, the data found.

Many are capitalizing on low-interest rates to refinance mortgages, student loans, or credit card debt to skirt spending on costly interest, according to the findings. Almost 23% of loan requests were to pay off credit card debt, according to Credible, up slightly from nearly 21% pre-pandemic.

Debt consolidation was the No. 1 reason Americans took out a personal loan during the pandemic, with 27% citing that reason. But that’s well below the nearly 42% who got a loan for that purpose before the COVID-19 outbreak began.

“If you were doing well before the pandemic and you haven't lost your job, you're probably in a good position to make moves that can improve your personal financial health,” Humann said. “It’s a good opportunity if you're in that position to sort of take stock of your debt and work out how you can put yourself in a better position.”

Spending priorities also have shifted away from conventional adulthood milestones like marriage and children and more towards recreation and leisure, the data found.

Loan requests earmarked for wedding financing are down 25%, and applicants seeking loans for engagement rings and money to welcome a new baby or adoption fees are up modest 15% and 43%, respectively.

Applications for personal loans also point to a broader trend that Americans are making the most of their self-quarantine and using the time to invest in where they live. The share of personal loan applications for home improvement projects are up 64% since pre-pandemic. Home-buying loans are only up 30% and loans for moving relocation expenses increased just 14%.

“With many people working from home during the pandemic, it’s not surprising that there’s more interest in home improvement projects,” Humann said. “A personal loan can provide quicker access to funds than a home equity loan or cash-out mortgage refinance, but the tradeoff is that you may pay a higher interest rate.”

Stephanie is a reporter for Yahoo Money and Cashay, a new personal finance website. Follow her on Twitter @SJAsymkos.

Read more:

'I don't want to die by going back to school': Teachers pen wills before returning to classrooms

Coronavirus puppy scams 'seemed legit,' ensnared dog lovers amid pandemic: Illegal Tender podcast

American tourists face bans and restrictions across the world amid shoddy pandemic response

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money