8 Low Interest Student Loans

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

This article first appeared on the Credible blog.

If you’re looking for a student loan to help pay for the cost of college, federal Direct Loans usually offer the lowest interest rates.

Those with excellent credit, however, might be able to find lower rates with private student loans. Your financial information, including your credit history, can help you qualify for low interest student loans.

If you’ve already exhausted your federal student loan options, here’s how to find low interest student loans.

With Credible, you can easily compare private student loan rates in minutes for free, and without affecting your credit.

1. Have good credit

Once you use up subsidized and unsubsidized federal student loans, it’s a good idea to consider private student loans. There are several factors in the interest rate, but one of the biggest factors is your credit. A good credit score can be the difference between getting approved at all.

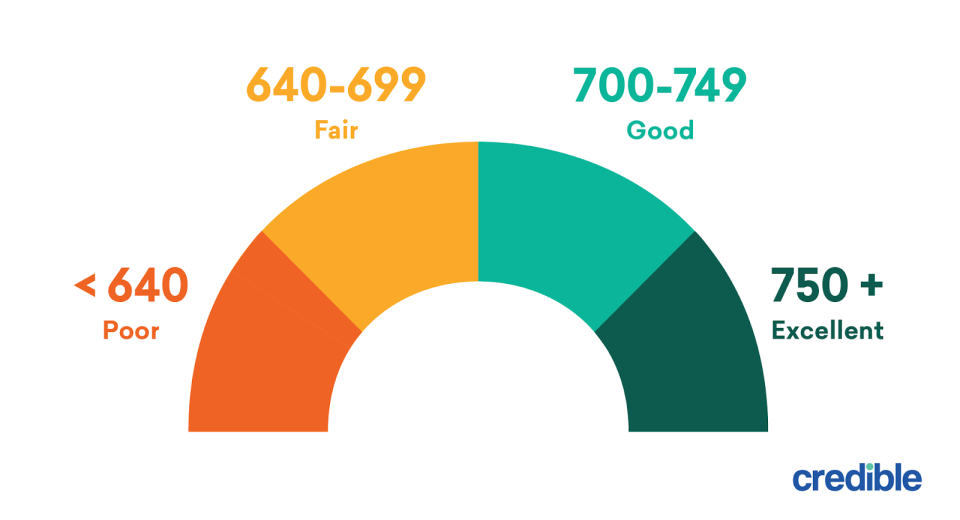

Generally, a good to excellent credit score can qualify you for better interest rates, while poor credit might mean you qualify for higher rates. If you don’t know your credit score, you can get access for free through several popular apps.

2. Focus on debt to income

In addition to looking at your credit, lenders also consider your existing debt. They’ll add up all of your minimum monthly payments for existing debts compared to your income. A higher debt load compared to your income shows a risk that you might not be able to repay the new loan. A lower debt-to-income ratio shows you’re in a strong position to make regular payments. Typically, lenders look for a DTI of 50% or lower — the lower the better.

If you’re able to pay off any credit card balances or other loans at least a month before applying for your student loans, it will lower your minimum monthly payments on your credit report and improve your debt-to-income. This could help you qualify for lower student loan rates. Make sure you’re not closing these accounts, though; that could actually hurt your credit score.

How to calculate your DTI: (Total monthly payments ÷ monthly income) x 100 = DTI

3. Get a cosigner

If you have bad credit or no credit, it could take more time than you have to turn around your credit or establish a good credit score. In that case, you might do better with a cosigner. Cosigners can share their good credit score with you to qualify for a lower rate. However, they also take on full responsibility for repaying the loan.

Many students usually look to their parents to cosign — in fact, over 90% of private student loans are cosigned. Grandparents and other relatives might also consider cosigning.

Credible allows you to compare different cosigners on your loan to help you see which cosigner will help get you the lowest rate.

4. Choose a shorter repayment term

If you’re able to afford a higher monthly payment, a shorter repayment term saves you money in a couple of ways:

Save money with a lower interest rate: Longer term loans are considered riskier by lenders, so typically the longer the term, the higher the rate. With a shorter term, you can get a lower rate and pay less over the life of your loan.

Paying interest for a shorter period of time: With a shorter term, you’ll be paying off your loan sooner. When your loan is paid off sooner, you stop paying interest.

5. Look for discounts

Some student lenders are willing to give you a discount for meeting certain criteria or requirements. For example, many popular lenders give a 0.25% discount when you enroll in automatic payments. But keep in mind that if you’re not paying your loan off when in school, this discount usually won’t apply and the higher interest rate will accrue.

Keep in mind: For a 10-year, $10,000 loan with a 5% interest rate, you would pay a total of $2,728 in interest. With a 0.25% discount, you would pay $2,582 in total interest. That’s a savings of $146. Plug your own numbers into Credible’s student loan interest calculator to estimate how much you could save on your own loans.

Some lenders might have other unique discount programs to further lower your rate — like loyalty or good-grade discounts. If you qualify, definitely take advantage of these as they can really add up.

With Credible, you can easily compare private student loan rates without affecting your credit score.

6. Compare lenders

Federal student loan rates are set by the government, but private lenders can set their own rates for student loans. Shopping around will help you find the right loan for your situation.

Credible helps you save time shopping around by letting you compare offers from multiple lenders by filling out just one simple form.

Low interest student loans for parents

Parents looking to take on student loans to help finance their student’s education might consider Parent PLUS Loans first, but that isn’t your only loan option. Parents with good credit scores might be able to find cheaper loans through private lenders than the PLUS program.

Parents might also be able to save on existing PLUS loans by refinancing to a new loan with a lower interest rate. Be sure to note the origination fee on Parent PLUS loans that can significantly increase the loan’s APR, often by about a full percentage point.

Take charge of your student loan interest rates

It can feel like the government, banks, and other lenders are in charge of your student loan interest rates, but you have a lot of influence over whether you have low interest student loans or pay more.

With a focus on your credit and other aspects of your finances, you might be able to lower your existing loan rates or qualify for lower rates in the future.

About the author: Eric Rosenberg is an expert on personal finance. His work has been featured at Business Insider, Investopedia, The Balance, The Huffington Post, MSN Money, Yahoo Finance, Mint.com and more.

The post 8 Low Interest Student Loans appeared first on Credible.

money

money