Why 2019 was one the 'greatest, easiest years ever for investors': Morning Brief

Tuesday, December 3, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

And why Jeffrey Gundlach thinks the future won’t be so easy

“I think 2019 has turned out to be one the greatest, easiest years ever for investors,” DoubleLine Capital CEO Jeffrey Gundlach told Yahoo Finance on Monday.

“Just throw a dart and you're up 15%, 20%. Not just in the United States, but in global stocks as well.”

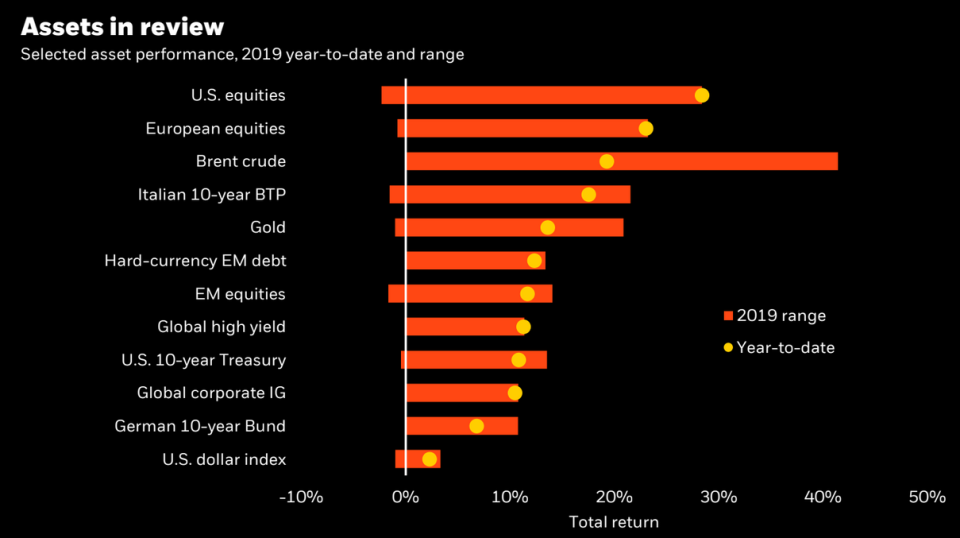

As the following chart published by BlackRock on Monday shows, Gundlach’s comments just about sum it up.

And not only is it just about everything on this chart up double-digits, the year-to-date ranges show that many of these assets were hardly ever down and remain just below their highs for the year. The chart shows that many investors are likely heading into the final month of the year in a victory formation.

Gundlach’s view on 2019, however, isn’t an exaltation of the current market but a reason for some caution in the years ahead.

Gundlach believes that the U.S. stock market’s outperformance relative to the rest of the world will come to an end, repeating a pattern of U.S., Japanese, European, and EM markets all taking their turn outperforming for a time and then lagging in the decades that follow.

And so just as the Japanese market’s primacy in the 1980s and the outperformance of emerging markets pre-crisis came to an end, so too does Gundlach expect the U.S. market’s relative outperformance to fade in the next downturn.

“My belief is that that pattern will repeat itself,” Gundlach said. “In other words, when the next recession comes, the United States [stock market] will get crushed and will not make it back to the highs that we’ve seen — that we’re kind of floating around right now — probably for the rest of my career.

“Now my career doesn’t have 30 years to go, but it also doesn’t have one or two to go.”

So while our collective memories may be more fleeting in today’s on-demand world, it was only a year ago that investors were in the midst of suffering the worst fourth quarter and overall year since the crisis. In a note to clients published last week, strategists at Goldman Sachs summed up 2019 by calling it a “bull market in everything (after a bear market in everything).”

And I think Goldman’s analysis and Gundlach’s warnings to investors both speak to a certain hollowness it seems most investors feel when it comes to this year’s market. Because the strong performance of many financial assets in 2019 are really backstopped not by what did happen in markets this year, but what didn’t.

Namely, the economy didn’t tip into recession. The Federal Reserve didn’t continue raising rates. And Trump’s trade war didn’t escalate indefinitely.

But the global economy is slowing and the trade war still exists. Concerns also abound over the rush into private equity and the premiums being paid for these businesses. Unicorn IPOs have broadly struggled during 2019’s stellar market. The weed stock and cryptocurrency bubbles continue to deflate.

So, sure, everything might be awesome if you look at the S&P 500. And the desire to view good developments in markets as a necessary harbinger of more challenging days ahead is one the laziest tropes in the business.

But a theme we’ve seen emerge in this market at various points in 2019 also might be an apt explanation for the year at-large: there’s a calm masking big changes and big challenges just below the surface. Changes and challenges Gundlach believes will be unpleasant to face in the years ahead.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him @MylesUdland

What to watch today

Economy

Wards Total Vehicle Sales, November (16.80 million expected, 16.55 million in October)

Earnings

Post-market

4 p.m. ET: Workday (WDAY) is expected to report third-quarter adjusted earnings of 37 cents per share on $920.82 million in revenue

4:05 p.m. ET: Salesforce.com (CRM) is expected to report third-quarter adjusted earnings of 66 cents per share on $4.52 billion in revenue

From Yahoo Finance

Best-selling author and financial journalist Michael Lewis will be on The Final Round, which begins at 3 p.m. ET.

Top News

Trump: No deadline for China trade deal, might follow 2020 election [Reuters]

Champagne to cheese: US prepping $2.4B of tariffs on French goods [Yahoo Finance UK]

China hints U.S. blacklist imminent in threat to trade talks [Bloomberg]

PG&E failed to inspect transmission lines that caused deadly 2018 wildfire: state probe [Reuters]

YAHOO FINANCE HIGHLIGHTS

Where you should invest your money in the next decade: strategists

Andrew Yang notches personal fundraising record by raising $750,000 in 24 hours

Pete Buttigieg's new plan targets social factors of health care

57% of boomers who manage their own money should rebalance their portfolios: Fidelity

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money