3 in 5 older workers could retire in poverty due to pandemic

The majority of older workers could end up poor in retirement because of the economic fallout from the pandemic, according to a recent study.

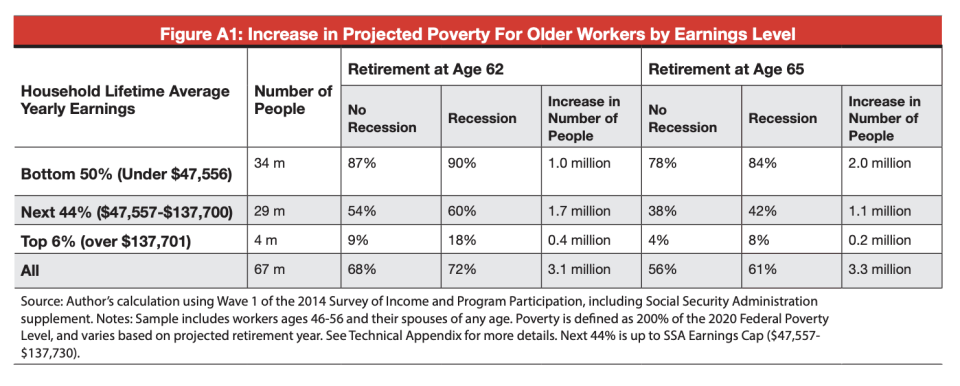

Sixty-one percent of workers 55 and over may retire in poverty when they reach 65, according to the study from the Schwartz Center for Economic Policy Analysis at The New School, up from 56% if no recession occurred this year. About 3.1 million workers will be forced to leave the labor force and into involuntary retirement because of the COVID-19 outbreak, another analysis from the center found.

“This is the first time in 50 years we have seen such a high rate where workers have to retire and collect Social Security earlier than planned,” said Teresa Ghilarducci, director at the Schwartz Center. “It will tip the scale in terms of the percentage of older workers that will be poor retirees.”

The job losses coupled with the health crisis posed by the coronavirus exacerbate an already grim outlook for retirement in America.

‘Americans were unprepared for retirement’

Since March 2020, about 2.9 million workers in the 55-70 age cohort left the labor force, or 50% more than the first three months of the Great Recession. Another 1.1 million older workers will be forced out of the labor force by the end of the year, according to the study’s forecast.

The bulk of those falling into poverty will be low-income earners, who are less likely to have retirement savings. But COVID-related financial market losses and emergency withdrawals from retirement accounts could also leave half of middle earners with less than $5,000 in savings when they finally retire, the center found.

Read more: Read more: Here's how to recession-proof your retirement plan

“The unfortunate reality is that many Americans were unprepared for retirement before the pandemic,” said Jason Field, a financial advisor at Van Leeuwen & Company. “And that has not changed.”

‘There is a permissive attitude around age discrimination’

While younger workers may recoup their job losses as the economy reopens, older Americans will have a harder time returning to work due to COVID-related health risks and age discrimination.

“It looks like there is a permissive attitude around age discrimination as there is no sign this administration will post any work standard laws even with a resurgence of age discrimination,” Ghilarducci said.

She noted that Republicans haven’t established a platform for retirement security, but Democratic presidential candidate Joe Biden publicized a plan for lowering the Medicare eligibility age for older workers in case they lose health insurance.

Read more: Retirement planning: Everything you need to know

“I also think this recession is causing a lot more permanent layoffs, and in the next three months or so, employers are using it as an excuse to restructure and are getting higher paid people laid off,” Ghilarducci said. “We need a stimulus package that will help everyone but that has special protections for older workers such as more unemployment benefits for those above 55.”

Dhara is a reporter Yahoo Money and Cashay. Follow her on Twitter at @Dsinghx.

Read more:

Most Americans didn’t tamper with their retirement savings even in pandemic, study finds

President Trump's promises to prevent evictions offers ‘false hope,’ experts say

Read the latest financial and business news from Yahoo Finance and Yahoo Money

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money