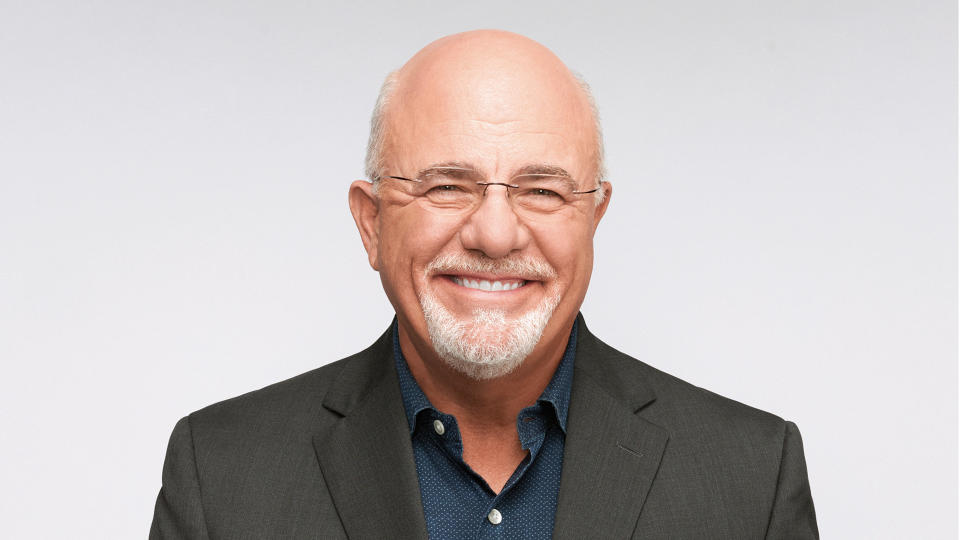

Dave Ramsey: 10 Genius Things To Do With Your Money

Dave Ramsey is one of the nation’s most celebrated respected and sought-after finance gurus for building wealth, a famous radio host, a successful businessman and a bestselling author. He’s also a self-made man who started with nothing and built a seven-figure net worth and a $250,000 annual income by age 26.

Check Out: This Is the One Type of Debt That ‘Terrifies’ Dave Ramsey

Learn More: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

Now in his early 60s, he has spent many years getting even richer by helping other people build wealth of their own. Here’s a look at some of the choicest wisdom and most sage advice that Dave Ramsey has doled out along the way to his legions of loyal followers.

Sponsored: Credit card debt keeping you up at night? Find out if you can reduce your debt with these 3 steps

Eliminate Debt Before You Invest

The No. 1 rule of the Ramsey investing philosophy is not to invest a dime — at least not until you eliminate all of your toxic debt, which he considers to be pretty much everything but your mortgage. Ramsey insists that you can’t build wealth when your primary wealth-building tool — your income — is tied up in monthly finance charges.

Harness the Power of the Snowball Method

Eliminating debt is easy to talk about but hard to do, which is why Ramsey is a longtime advocate of the so-called snowball method. This debt-reduction strategy requires you to attack your debts in order of smallest to largest, allowing you to chalk up quick wins that close outstanding accounts while boosting your confidence along the way.

Once it’s time to confront your truly scary debts, you’ll have momentum on your side — plus, you’ll be able to concentrate only on them now that your smaller debts are no longer nipping at your heels.

Trending Now: Dave Ramsey: 7 Vacation Splurges That Are a Waste of Money

Build an Emergency Fund Before You Build Wealth

The first half of Ramsey’s top investing rule is to get out of debt. The second is to fully fund your emergency savings before you try to grow your money on the market. Eliminating debt puts you on solid financial ground; but, without enough cash in the bank to cover three to six months’ worth of expenses, you’re just one emergency away from being forced to tap into your retirement account.

Give 15% of Every Paycheck to Your Future Self

Once you’re free of debt and sitting on enough savings to survive at least a quarter of a year, Ramsey says the most important thing you can do with your paycheck is to save 15% of it — each and every pay period — in a tax-advantaged account. The best option is usually a 401(k) because every dollar from an employer match is free money, and free money is always a good thing. But if that’s not an option, a pre-tax IRA or after-tax Roth IRA are the next-best things.

Keeping Up With the Joneses Is an Unwinnable Game — Don’t Play

Sometimes the most important thing isn’t what you do with your money, but what you don’t do.

In “The Total Money Makeover: A Proven Plan for Financial Fitness,” Ramsey wrote, “We buy things we don’t need with money we don’t have to impress people we don’t like.”

In today’s world, social media influencers literally bank on your willingness to part with your cash to show off for people you don’t even know, much less like. Frivolous spending is the bane of wealth creation; remember, every dollar you wear is one you don’t save.

Utilize Money-Saving Technology

Modern society has access to incredible gadgets and software applications that would have been unimaginable just one generation ago. Many of them can save you money — and Ramsey wants you to take advantage of everyone.

That includes smart thermostats for lowering utility bills, banking apps that let you automate savings, smart shopping and coupon apps, budgeting apps and more.

Or, Buck the Trend and Go Low Tech

Technology can offer convenient tools for saving and growing your money, but Ramsey has plenty of followers who have built wealth the old-fashioned way. On his blog, Ramsey profiled a student named Kay N. who said, “Go old school and balance your checking account. This is essential! Balance your checking account so you know where you’re at and then begin with a basic budget. It’s all about taking baby steps.”

Put What You Already Know Into Practice

Acquiring knowledge is always a noble endeavor — unless it leads to paralysis by analysis. Remember that every hour you spend learning about new ways to manage and grow your money is one you don’t spend building a budget, creating a spending plan and investing for your future. Sure, you’d be wise to learn more as you go, but get started now with what you already know.

In “The Total Money Makeover (Classic Edition): A Proven Plan for Financial Fitness,” Ramsey wrote, “Winning at money is 80% behavior and 20% head knowledge. What to do isn’t the problem; doing it is. Most of us know what to do, but we just don’t do it. If I can control the guy in the mirror, I can be skinny and rich.”

Never Enter a Grocery Store Without a Plan

On his blog, Ramsey cites USDA research that shows even the thrifty average family of four spends nearly $1,000 per month on groceries.

But you can shrink that number by eliminating what Ramsey calls “budget busters” — small, unplanned impulse purchases that add up to big money misspent. His solution is to shop only for the ingredients in a predetermined meal plan — and never to deviate from the plan no matter what. He also recommends ordering online and picking up your groceries to avoid temptation — or at least leaving the kids at home when you go to the supermarket.

Know What You Don’t Know and Work With a Pro

According to his own blog, Ramsey still works with a professional advisor to help guide his investments and overall financial strategy. No matter how much you keep up with news and trends, a good money pro will have greater insight and a better perspective based on their own experience and what you tell them about your goals, strategy and circumstances.

More From GOBankingRates

How Much Does the Average Middle-Class Person Have in Savings?

5 Reasons You Should Consider an Annuity For Your Retirement Savings

This article originally appeared on GOBankingRates.com: Dave Ramsey: 10 Genius Things To Do With Your Money

money

money